Adjusting entrie Study guides, Class notes & Summaries

Looking for the best study guides, study notes and summaries about Adjusting entrie? On this page you'll find 11 study documents about Adjusting entrie.

All 11 results

Sort by

-

Summary Accounting (Financial part) IBA

- Summary • 39 pages • 2022

- Available in package deal

-

- $9.93

- 3x sold

- + learn more

Summary for the course Accounting International Business Administration at VU Amsterdam, a first-year course. This summary covers the first part of the course, which is financial accounting. The summary is equipped with several accessibilities such as the 'GO BACK BUTTON' that helps you to go through the summary in a few seconds.

-

Adjusting Entries - Deferrals

- Other • 5 pages • 2023

-

- $7.99

- + learn more

In this assignment, you'll be given a set of financial data for a company, and you'll need to use your knowledge of deferrals to make the necessary adjusting entries. You'll need to identify any prepaid expenses or unearned revenues and adjust the appropriate accounts to ensure that the company's financial statements are accurate.

This assignment is perfect for students who want to gain a better understanding of the accrual basis of accounting and how to properly adjust and journalize entries.

-

Problem 3-3A Preparing adjusting entries, adjusted trial balance, an

- Exam (elaborations) • 1 pages • 2023

-

- $7.17

- + learn more

Problem 3-3A Preparing adjusting entries, adjusted trial balance, and financial statements LO A1, P1, P2, P3 Wells Technical Institute (WTI), a school owned by Tristana Wells, provides training to individuals who pay tuition directly to the school. WTI also offers training to groups in off-site locations. Its unadjusted trial balance as of December 31, 2013, follows. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Descriptions of items a through h...

In this assignment, you'll be given a trial balance for a company and a series of adjustments, and you'll need to make the appropriate adjusting entries to reflect the company's expenses and revenues.

Making these accrued adjusting entries is an essential part of the accrual basis of accounting, and this assignment will help you gain a better understanding of how they work.

After reading this document you will be able to: 1. Understand the concept of Adjusting Entries. 2. Enumerate the 4 types of Adjusting Entries. 3. Explain by detail the rationale for each adjusting type.

-

What is the revenue recognition principle What is the revenue recognition principle? What is the expense recognition principle? In your opinion, why are these important to financial reporting. 2. What are the four different adjusting entries? What accoun

- Summary • 5 pages • 2021

-

- $3.49

- + learn more

What is the revenue recognition principle What is the revenue recognition principle? What is the expense recognition principle? In your opinion, why are these important to financial reporting. 2. What are the four different adjusting entries? What accounting assumptions necessitate the use of adjusting entries? What accounts are subject to adjusting journal entries? What are your thoughts on making adjusting entries; are they really needed or is this just extra work by accountants? What are the...

-

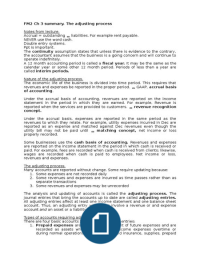

Fm2 Chapter 3 Adjusting Entries

- Summary • 5 pages • 2016

- Available in package deal

-

- $3.30

- + learn more

A complete summary of chapter 3. HvA, IBMS first year. Financial Management 2.

$6.50 for your textbook summary multiplied by 100 fellow students... Do the math: that's a lot of money! Don't be a thief of your own wallet and start uploading yours now. Discover all about earning on Stuvia