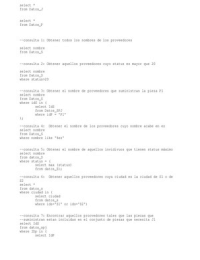

Guide

1. a _________ ________ is the simplest form of business Sole Proprietorship

where the owner is the business. The owner reports

his/her personal income tax return and is legally re-

sponsible for all debts and obligations incurred by the

business

2. An agreement by two or more persons to carry Partnership

on, as co-owners, a business for pro�t is called a

______________

3. a _______________ _____________ is one consisting of one Limited Partnership

or more general partners (who manage the business

and are liable to the full extent of their personal assets

for debts of the partnership) and one or more limited

partners (who contribute only assets and are liable

only to the extent of their contributions)

4. a ______________ ___________ ____________ is a hybrid form LLC (limited liability com-

of business enterprise that o ers the limited liability pany)

of the corporation but the tax advantages of a part-

nership

5. a _______________ is a legal entity formed in compli- Corporation

ance with statutory requirements. The entity is dis-

tinct from its shareholders/owners

6. a form of partnership that allows professionals to LLP (Limited Liability Part-

enjoy the tax bene�ts of a partnership while limiting nership)

their personal liability for the malpractice of other

partners

7. Sole Proprietorship 4 things will, unlimited, owners,

Method of Creation- It is created at ________ by the personal

, owner

Liability- _____________ liability

Management- Completely at the ________ discretion

Taxation- owner pays _________ taxes on business in-

come

8. Partnership 4 things agreement, unlimited,

Method of Creation- created by an ___________ of the equal, pro rata

parties

Liability- _____________ liability

Management- Each partner has a direct and __________

say in management unless otherwise stated in the

agreement

Taxation- Each partner pays a ____ _____ share of in-

come taxes on the net pro�ts, whether or not they are

distributed

9. Corporation 4 things statutory, limited, not,

Method of Creation- Authorized under _________ laws elect, double taxation

under the states corporation laws

Liability- ________ liability of shareholders, sharehold-

ers _____ liable for the debts of the corporation

Management- Shareholders ______ directors who set

policy and and appoint o cers

Taxation- ___________ ____________- corporation pays in-

come tax on net pro�t, no exclusion for dividends, and

then shareholders pay income tax on the disburse-

ment of dividends that they receive

10. Limited Partnership 4 things general, limited, unlimit-

Method of Creation- Created by an agreement, at least ed, general, limited, con-

one party must be a _________ partner, and at least one

, party must be a __________ partner tributions, general, limit-

Liability-________ liability for _______ partners, ________ ed, pro rata

partners are liable only to the extent of their

__________

Management- ________ partners have equal voice (un-

less otherwise stated), while ______ partners may not

retain their current liability status if they actively par-

ticipate in mgmt

Taxation- like a normal partnership, each partner pays

a ____ ____ share of income taxes

11. LLC 4 things agreement, charter, in-

Method of Creation- created by an ___________ of the vestments, participate,

members of the company, articles of organization are not, passed through

�led and a ______ must be issued by the state

Liability-members liability is limited to the amount of

their _______

Management- members can fully _________ in mgmt or

can designate a group of persons to act on behalf of

the members

Taxation- the LLC is _____ taxed and members are

taxed personally on pro�ts "________ _______" the LLC

12. LLP 4 things quali�cation, limited,

Method of Creation- Created by agreement of the equal, pro rata

partners, a statement of ___________ if �led

Liability- It varies, but under the uniform partnership

act, liability of a partner for acts committed by other

partners is _____

Management- Same as a general partnership, part-

ners have ______ say unless otherwise stated in the

agreement

, Taxation- Same as a general partnership, each partner

pays a ____ ____ share of income taxes on net pro�ts

13. in a general partnership ownership is split ______ re- equally, 25

gardless of capital contributions, unless otherwise

stated.

So if there are four partners, and I put up 50% of the

capital in order to start the business, unless otherwise

stated I still only own _____% of the thing.

14. Some Limited partnerships set up an ____-Corporation S, LLC

or an ___ as the general partner and then individuals

who actually own the company are the limited part-

ners.

15. a person who agrees to represent or act for another agent

is an ______

16. a _______ is the person whom the agent represents or principal

acts on behalf of

17. a _________ is a person having a special duty, created �duciary

by their agreeing to act for the bene�t of another

18. the most common type of agency relationship is employer-employee

____________-__________ relationships, an example of

this would be a salesperson in a department store

19. a type of agency relationship where the agent is not employer-independent

directly controlled by the principal, just temporarily to contractor

see some purpose to an end- this would be called an

___________-____________ _________ relationship. An ex-