California Life, Accident and Health Cram Course Exam 1-3 Already Passed

California Life, Accident and Health Cram Course Exam 1-3 Already Passed Question #90476 Carol is injured driving a company car at work. Her Health insurance coverage: AProvides excess or supplementary coverage BWill provide coverage on a pro-rata basis with Workers Compensation CWill cover her injuries DWill not cover her since this is an occupational injury D Explanation: Most Health insurance provides 'non-occupational' (off the job) coverage for sickness or injury, meaning that occupational coverage is excluded. However, if a person is not required to be covered by Workers Compensation, some Health policies will cover both on and off the job, which is known as 'occupational' coverage. Question #90486 The minimum participation percentage for large group insurance under the California code is: A50% B40% C75% D25% C Explanation: The California Insurance Code requires a 75% minimum participation percentage for large group Life insurance. Question #90409 All of the following are classified as Life insurance EXCEPT: AWhole life BTerm CEndowment DAccidental Death & Dismemberment (AD&D) D Explanation: AD&D is a type of Disability (Health) insurance, not Life. Question #90464 A client invests $50,000 in after-tax dollars into a deferred annuity over a period of time. When he annuitizes, he will receive $4,000 a year over his projected life span. If his total return is expected to be $100,000, how much of the client's $4,000 annual annuity pay-out will be taxable each year for the first 10 years: A$800 BNone C$4,000 D$2,000 D Explanation: The client has $100,000 in his account, of which $50,000 is his own money, which was contributed with after-tax dollars. Since his contributions will be returned tax free and since they make up half of his account value, only half of his annual pay-out (the earnings portion) will be taxable as ordinary income. Further, you can find his projected life span by dividing the $100,000 total by his $4,000 annual pay-out, which would be 25 years. After 25 years, he will have recovered all of his own contributions, so the entire $4,000 would be taxable. Remember, annuity payouts are for life. Question #90470 Which of the following is true regarding 'speculative' risk: AThere is no chance for gain BIt has a chance for gain or loss CIt is insurable DIt has a chance for loss only B Explanation: Speculative risk has the chance for gain or loss and is not insurable. For example, if you buy a lottery ticket you might gain, but you will probably lose. It is 'pure' risk that is insurable, which has the chance for loss only, with no chance for gain. On Life insurance, you might die. On Health insurance, your might become sick or injured. On Fire insurance, your house could burn down. These are 'pure' risks. Question #90425 Part A of Medicare provides basic hospital benefits including coverage for the care and counseling of the terminally ill, which is known as: ALong term care BHome health care CSkilled nursing facility care DHospice care D Explanation: Medicare is a federal health insurance program for people 65 or older who qualify for Social Security, people of any age with permanent kidney failure, and those who are permanently and totally disabled. An individual is automatically eligible for Medicare Part A with no monthly premium at age 65, which includes coverage for hospitalization,

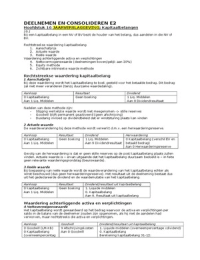

Geschreven voor

- Instelling

- California Life, Accident and Health Cram

- Vak

- California Life, Accident and Health Cram

Documentinformatie

- Geüpload op

- 4 februari 2023

- Aantal pagina's

- 107

- Geschreven in

- 2022/2023

- Type

- Tentamen (uitwerkingen)

- Bevat

- Vragen en antwoorden

Onderwerpen

- california life

-

accident and health cram course exam 1 3 already passed

-

question 90476 carol is injured driving a company car at work her health insurance coverage

Ook beschikbaar in voordeelbundel