Vertical analysis: compare outcome with industry averages or benchmark

(norm).

Vertizontal analysis: vertical + horizontal, compare with industry over the

years.

Golden Balance Rule: upper part of balance sheet, two ratios with five norms.

Two ratios are always complementary, sometimes contradictionary.

Growth Working Capital Ratio: current assets should be 130% bigger

than current liabilities (Z-curve), conservative financial structure. If you

have more current assets you are more liquid.

Golden Balance Rule Ratio: four norms:

o Absolute norm: 0<GBR−R<1 , not possible to have negative

balance sheet items (except for equity). So GBR-R will be negative if

equity is more negative than sum of provisions, LT liabilities, and

shareholders’ equity (technical bankruptcy really bankrupt if not

liquid anymore).

GBR−R>1 : illiquidity (worse than technical bankruptcy).

o Favorite range: 0.5<GBR−R<0.8

0−0.5 : over liquidity, too much liquidity.

0.8−1 : entering illiquidity.

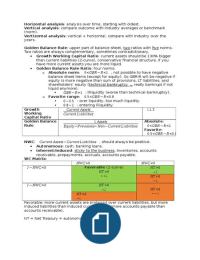

Growth Current Assets ¿ 1.3

Working Current Liabilities

Capital Ratio

Golden Balance ¿ Assets Absolute:

Rule Equity + Provisions+ Non−Current Liabilities 0<GBR−R<1

Favorite:

0.5<GBR−R<0.8

NWC: Current Assets−Current Liabilities , should always be positive.

Autonomous: cash, banking loans.

Inherent/induced: sticky to the business, inventories, accounts

receivable, prepayments, accruals, accounts payable.

WC Matrix:

NWC >0 NWC<0

I −NWC<0 Favorable (Z-curve) NT >0

NT >0 +¿

++¿ NT <0

−¿

I −NWC>0 NT >0

+¿ NT <0

NT <0 −−¿

−¿

Favorable: more current assets are preferred over current liabilities, but more

induced liabilities than induced current assets (more accounts payable than

accounts receivable).

NT = Net Treasury = autonomous NWC.

, Current Ratio Current Assets ¿ 1.3

(3rd grade Current Liabilities

liquidity)

Quick Ratio (2nd Current Assets−Inventory ¿1

grade liquidity) Current Liabilities

Cash Ratio (1st Deposits+Cash ¿ 0.2

grade liquidity) Current Liabilities

Financials should always start with 1st grade liquidity and then calculate bottom

up.

Situation: Cash Ratio<0.2 calculate lack of 1st grade liquidity (

0.2−outcome Cash Ratio ). Quick Ratio>1−lack of 1st grade liquidity (since not

allowed to make tradeoff). Only deduct if there’s shortage.

st

Current Ratio >1.3−lack of 1 grade liquidity . Only deduct Cash Ratio.

Why Cash Ratio > 0.2? Ratio is for all branches/industries, every company.

1. Risk mitigation (buffer).

2. Sinking fund for investments (CAPEX, PPE).

3. Opportunity reason in order to make quick moves.

4. Hostile takeover; can’t be planned easily.

Loan-to-Deposit Financial Cushion Deposits+Cash ¿ 0.5

Ratio (L-t-D)

=

Autonomous ST Liabilities Autonomous ST Liabilities

Capital ¿ Assets+ Induced /Trade NWC+ Financial Cushion

Employed

Return on EBIT ¿ 16 >WACC

Capital ¿ Assets+ Induced/ Trade NWC + Financial Cushion

Employed

(ROCE)

Return on Net Net Earnings

Assets (RONA) ¿ Assets+ NWC

Cash conversion cycle (days working capital):

Purchase markets: Starbucks:

1. Primary process: coffee,

water, cups, tea

2. Secondary process: toilet

paper, insurance, printer,

fees.

Stock-to-fulfill:

1. Parts

2. Finished goods

Production-to-stock: all pieces/materials in machines in order to produce.

Cash doesn’t flow in same pace as products. There might be an abundance or

shortage of cash capital markets.

Days working capital (DWC): days cash is traveling through induced process

of CCC (90 days), take average figures of balance sheet if possible: