Instructor manual

MC1 MATCHA CREATIONS

(a) Mei-ling has a choice between a sole proprietorship and a corporation. A

partnership is not an option since she is the sole owner of the business.

A proprietorship is the easiest to create and operate because there

are no formal procedures involved in creating the proprietorship. However, if

she operates the business as a proprietorship she will personally have unlimited

liability for the debts of the business. Operating the business as a corporation

would limit her liability to her investment in the business. Mei-ling will in all

likelihood require the services of a lawyer to incorporate. Costs to incorporate

as well as additional ongoing costs to administrate and operate the business as a

corporation may be costly.

My recommendation is that Mei-ling choose the corporate form of business

organization. If she expands the business after graduation, she can raise

additional capital by issuing more shares. In addition, she limits her liability to

Copyright © 2019 John Wiley & Sons, Inc. Weygandt Financial Accounting IFRS 4e Solutions to

Matcha Creations

(For Instructor Use Only)

, her investment in the business. If she decides to transfer ownership to another

student, she can do so without dissolving the corporation.

Copyright © 2019 John Wiley & Sons, Inc. Weygandt Financial Accounting IFRS 4e Solutions to

Matcha Creations

(For Instructor Use Only)

,MC1 (Continued)

(b) Yes, Mei-ling will need accounting information to help her operate her

business. She will need information on her cash balance on a daily or weekly

basis to help her determine if she can pay her bills. She will need to know the

cost of her services so she can establish her prices. She will need to know

revenue and expenses so she can report her net income for corporate income

tax purposes, on an annual basis. If she borrows money, she will need financial

statements so lenders can assess the liquidity, solvency, and profitability of the

business. Mei-ling would also find financial statements useful to better

understand her business and identify any financial issues as early as possible.

Monthly financial statements would be best because they are more timely, but

they are also more work to prepare.

(c) Assets: Cash, Accounts Receivable, Supplies, Equipment, Prepaid Insurance

Liabilities: Accounts Payable, Unearned Service Revenue, Notes Payable

Equity: Share Capital—Ordinary, Retained Earnings, Dividends

Revenue: Service Revenue

Copyright © 2019 John Wiley & Sons, Inc. Weygandt Financial Accounting IFRS 4e Solutions to

Matcha Creations

(For Instructor Use Only)

, Expenses: Advertising Expense, Supplies Expense, Utilities Expense,

Depreciation Expense

(d) Mei-ling should have a separate bank account. This will make it easier to

prepare financial statements for her business. The business is a separate entity

from Mei-ling and must be accounted for separately.

MC2 MATCHA CREATIONS

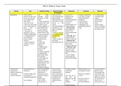

(a) GENERAL JOURNAL J1

Account Titles and Explanation Debit Credit

Nov. 8 No entry required for selling her

investments—this is a personal

transaction.

Copyright © 2019 John Wiley & Sons, Inc. Weygandt Financial Accounting IFRS 4e Solutions to

Matcha Creations

(For Instructor Use Only)