Solution Manual for Financial Statement Analysis & Valuation, 6th edition By Peter D. Easton

Computing and Analyzing

Cash Flows

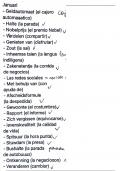

Learning Objectives – Coverage by question

True/False Multiple Choice

LO1 – Describe the framework for the statement of 1-9, 17,

1, 2, 5, 12-14, 18

cash flows. 18, 20, 21, 26

LO2 – Determine and analyze net cash flows from

4, 6, 8-11, 15 6-11, 19

operating activities.

LO3 – Determine and analyze net cash flows from

3, 14-16 17-19

investing activities.

LO4 – Determine and analyze net cash flows from

3, 13, 17-19 20-22

financing activities.

LO5 – Examine and interpret cash flow information.

LO6 – Compute and interpret ratios based on

20, 21 23-25

operating cash flows.

LO7 – Explain and construct a direct method statement

7 12-16

of cash flows (Appendix BB).

These questions are available to assign in myBusinessCourse.

© Cambridge Business Publishers, 2021

B-1 Financial Statement Analysis & Valuation, 6th Edition

,Appendix B: Computing and Analyzing Cash Flows

True/False

Topic: Cash and Cash Equivalents

LO: 1

1. The statement of cash flows encompasses only a firm’s cash because cash equivalents are really

marketable securities, which are short-term investments.

Answer: False

Rationale: Cash equivalents may be marketable securities but because they have very short

maturities, they are treated like cash.

Topic: Sections in Statement of Cash Flows

LO: 1

2. The statement of cash flows separates cash flows into operating, nonoperating, and financing

categories.

Answer: False

Rationale: The three sections are operating, investing and financing.

Topic: Sections in Statement of Cash Flows

LO: 3, 4

3. Information about noncash investing and financing activities must be disclosed in a schedule that is

separate from the statement of cash flows.

Answer: True

Rationale: Investors want to know about all the company’s investing and financing, not just those

transactions that required an actual cash outlay.

Topic: Direct versus Indirect Statement of Cash Flows

LO: 2

4. Two different methods of determining and presenting the net cash flow from operating activities are

the direct method and the reconciliation method.

Answer: False

Rationale: The two methods are the direct and indirect method.

Topic: Format of the Statement of Cash Flows

LO: 1

5. The net change in cash during a period must equal the net change in all other balance sheet

accounts.

Answer: True

Rationale: The net change in cash affected other accounts via operating, investing, and financing

transactions. Given double-entry bookkeeping, the two must balance.

© Cambridge Business Publishers, 2021

B-2 Financial Statement Analysis & Valuation, 6th Edition

,Topic: Indirect Method of Statement of Cash Flows

LO: 2

6. The direct method of presenting the net cash flow from operating activities reconciles net income to

the net cash flow from operating activities.

Answer: False

Rationale: It is the indirect method that reconciles net income to the net cash flow from operating

activities.

Topic: Sections in Statement of Cash Flows

LO: 7

7. The direct method of presenting the net cash flow from operating activities shows the major

categories of operating cash receipts and payments.

Answer: True

Rationale: The direct method lists cash received from customers and cash paid for expenses.

Topic: Operating Section of Statement of Cash Flows

LO: 2

8. If accounts payable decreases during an accounting period, then the cash paid for merchandise

purchased is less than the merchandise purchases for the period.

Answer: False

Rationale: This would be the case if accounts payable increased during the period, not decreased.

Topic: Operating Section of Statement of Cash Flows

LO: 2

9. If prepaid insurance increases during an accounting period, then the cash paid for insurance is less

than the period’s insurance expense.

Answer: False

Rationale: A decrease in a prepaid amount means that the company paid less for insurance because

it had prepaid it the year before.

Topic: Operating Section of Statement of Cash Flows

LO: 2

10. If accounts receivable decrease during an accounting period, then the cash received from customers

is more than the sales revenue for the period.

Answer: True

Rationale: If receivables decrease, the company has collected cash from a previous period’s sales.

Topic: Operating Section of Statement of Cash Flows

LO: 2

11. Depreciation expense is added back to net income in determining the net cash flow from operating

activities under the indirect method.

Answer: True

Rationale: No cash is paid for depreciation expense. Therefore it must be added back to net income

to undo the expense that is included in net income.

© Cambridge Business Publishers, 2021

B-3 Financial Statement Analysis & Valuation, 6th Edition

, Topic: Operating Cash Flow

LO: 1

12. Cash received from customers for services rendered is classified as a cash flow from operating

activities in a statement of cash flows.

Answer: True

Rationale: Customer related transactions are always operating activities.

Topic: Operating versus Financing Cash Flow

LO: 1, 4

13. Caterpillar Inc. sells heavy equipment and also finances the sales for its customer. The interest earned

from customers on the financing piece of the sale is classified as cash from financing activities on the

statement of cash flows.

Answer: False

Rationale: Customer related transactions are always operating activities, even if the cash is from

financing for the customer.

Topic: Investing Cash Flow

LO: 1, 3

14. Cash received from the sale of one of a firm’s warehouses is classified as a cash flow from operating

activities in a statement of cash flows but only if the warehouse was used for ordinary operations.

Answer: False

Rationale: Long-term productive assets are investment activities.

Topic: Investing Cash Flow

LO: 2, 3

15. A gain from the sale of a company’s property, plant, and equipment does not appear in the statement

of cash flows prepared on the indirect method.

Answer: False

Rationale: A gain from the sale of a company’s property, plant, and equipment is a noncash item that

is deducted from net income to arrive at cash from operations.

Topic: Investing Cash Flow

LO: 3

16. Sales proceeds from disposal of marketable securities that are debt instruments such as long-term

bonds represent cash from investing activities.

Answer: True

Rationale: Marketable securities are investments.

Topic: Financing Cash Flow

LO: 4

17. Cash paid as dividends to stockholders is classified as a cash flow from financing activities in a

statement of cash flows.

Answer: True

Rationale: Dividends paid are transactions with shareholders, which are always financing.

© Cambridge Business Publishers, 2021

B-4 Financial Statement Analysis & Valuation, 6th Edition