AAMI Accounting 2 Final 2025 COMPREHENSIVE EXAM QUESTIONS

AAMI Accounting 2 Final

|FREQUENTLY TESTED QUESTIONS |RECENTLY TESTING REAL EXA

Study online at https://quizlet.com/_hb9rri

QUESTIONS|VERIFIED SOLUTIONS (100% CORRECT)

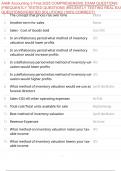

1. The concept that prices rise over time Inflation

2. Another term for sales Revenue

3. Sales - Cost of Goods Sold Gross Profit

4. In an inflationary period what method of inventory LIFO

valuation would lower profits

5. In an inflationary period what method of inventory FIFO

valuation would increase profits

6. In a deflationary period what method of inventory val- FIFO

uation would lower profits

7. In a deflationary period what method of inventory val- LIFO

uation would higher profits

8. What method of inventory valuation would we use as Specific Identification

funeral directors

9. Sales-CGS-All other operating expenses Net Profit

10. Total cost/Total units available for sale Weighted Average

11. Best method of inventory valuation Specific Identification

12. Revenue-Expenses Net Income

13. What method on inventory valuation raises your tax- FIFO

able income

14. What method of inventory valuation lowers your tax- LIFO

able income

1/8

, AAMI Accounting 2 Final

Study online at https://quizlet.com/_hb9rri

15. What are the 4 methods of inventory valuation Specific Identification

Weighted Average

FIFO

LIFO

16. Method used to determine the CGS for merchandise Inventory valuation

that is bought for resale in a retail or merchandising

business

17. Beginning Inventory + Net purchases Cost of goods available for

sale

18. Beginning inventory + Purchases - Ending inventory Cost of goods sold

19. The employees' withholding certificate is referred to as W-4

20. The wage and tax statement is W-2

21. Income before any payroll deductions is referred to as Gross Pay

22. Social security is financed by FICA

23. FICA stands for Federal Insurance Contri-

butions Act

24. Gross pay less payroll deductions Net Pay

25. Employee's take home pay Net pay

26. Deductions from an employees' paycheck Payroll tax

27. Sales-CGS Gross profit

28. The periodic allocation of costs of assets is referred to Depreciation

as

2/8

AAMI Accounting 2 Final

|FREQUENTLY TESTED QUESTIONS |RECENTLY TESTING REAL EXA

Study online at https://quizlet.com/_hb9rri

QUESTIONS|VERIFIED SOLUTIONS (100% CORRECT)

1. The concept that prices rise over time Inflation

2. Another term for sales Revenue

3. Sales - Cost of Goods Sold Gross Profit

4. In an inflationary period what method of inventory LIFO

valuation would lower profits

5. In an inflationary period what method of inventory FIFO

valuation would increase profits

6. In a deflationary period what method of inventory val- FIFO

uation would lower profits

7. In a deflationary period what method of inventory val- LIFO

uation would higher profits

8. What method of inventory valuation would we use as Specific Identification

funeral directors

9. Sales-CGS-All other operating expenses Net Profit

10. Total cost/Total units available for sale Weighted Average

11. Best method of inventory valuation Specific Identification

12. Revenue-Expenses Net Income

13. What method on inventory valuation raises your tax- FIFO

able income

14. What method of inventory valuation lowers your tax- LIFO

able income

1/8

, AAMI Accounting 2 Final

Study online at https://quizlet.com/_hb9rri

15. What are the 4 methods of inventory valuation Specific Identification

Weighted Average

FIFO

LIFO

16. Method used to determine the CGS for merchandise Inventory valuation

that is bought for resale in a retail or merchandising

business

17. Beginning Inventory + Net purchases Cost of goods available for

sale

18. Beginning inventory + Purchases - Ending inventory Cost of goods sold

19. The employees' withholding certificate is referred to as W-4

20. The wage and tax statement is W-2

21. Income before any payroll deductions is referred to as Gross Pay

22. Social security is financed by FICA

23. FICA stands for Federal Insurance Contri-

butions Act

24. Gross pay less payroll deductions Net Pay

25. Employee's take home pay Net pay

26. Deductions from an employees' paycheck Payroll tax

27. Sales-CGS Gross profit

28. The periodic allocation of costs of assets is referred to Depreciation

as

2/8