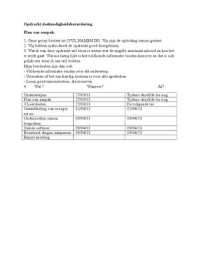

Case for Instructiecollege 4, Economics 1.2, Bedrijfskunde. Oligopoly.

In this case we study the oligopolistic behaviour of two airline companies, American

airlines and United airlines. They are the only airline companies that obtained the right to

operate on the route Chicago-LA. We assume that the services of the two airline

companies are homogenous to the customers and we have the following market demand

function for flights on this route

Q 339 p

with Q expressed in units of 1000 passengers, and p the price per passenger. The airline

companies have the same production technology and therefore have the same cost

function

c(q) 147q

with q the number of passengers in units of 1000 of the firm.

The Cournot model

Now assume that the airline companies in this market behave according to the Cournot

model.

A. Determine the Best-response, or, reaction function, of American airlines.

B. Also determine the Best-response function for United airlines.

C. Draw these two functions in the same graph.

D. How is the Cournot equilibrium determined according to this graph? Show which

output level each firm produces in the Cournot equilibrium, and compute the

equilibrium price and profit levels for both firms.

E. Compute the Cournot equilibrium values.

The Stackelberg model

We assume that American airlines can choose its output before United airlines. Thus, we

now assume that the two airline companies behave according to the Stackelberg model,

with American airlines as the leader and United airlines as the follower.

F. What will be the best strategy of the follower, United airlines?

G. What choice is made by American airlines? Compute the Stackelberg output

values for both airline companies and the price level in the equilibrium.

H. Compute the Stackelberg profit values for both companies.

The Bertrand model

Suppose that American airlines and United airlines choose their price level, rather than

their output level, according to the Bertrand model.

1

In this case we study the oligopolistic behaviour of two airline companies, American

airlines and United airlines. They are the only airline companies that obtained the right to

operate on the route Chicago-LA. We assume that the services of the two airline

companies are homogenous to the customers and we have the following market demand

function for flights on this route

Q 339 p

with Q expressed in units of 1000 passengers, and p the price per passenger. The airline

companies have the same production technology and therefore have the same cost

function

c(q) 147q

with q the number of passengers in units of 1000 of the firm.

The Cournot model

Now assume that the airline companies in this market behave according to the Cournot

model.

A. Determine the Best-response, or, reaction function, of American airlines.

B. Also determine the Best-response function for United airlines.

C. Draw these two functions in the same graph.

D. How is the Cournot equilibrium determined according to this graph? Show which

output level each firm produces in the Cournot equilibrium, and compute the

equilibrium price and profit levels for both firms.

E. Compute the Cournot equilibrium values.

The Stackelberg model

We assume that American airlines can choose its output before United airlines. Thus, we

now assume that the two airline companies behave according to the Stackelberg model,

with American airlines as the leader and United airlines as the follower.

F. What will be the best strategy of the follower, United airlines?

G. What choice is made by American airlines? Compute the Stackelberg output

values for both airline companies and the price level in the equilibrium.

H. Compute the Stackelberg profit values for both companies.

The Bertrand model

Suppose that American airlines and United airlines choose their price level, rather than

their output level, according to the Bertrand model.

1