Summary

Summary Tax 3A: Capital gains tax

Rating

Sold

-

Pages

10

Uploaded on

14-01-2022

Written in

2021/2022

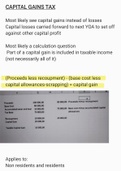

An in-depth summary of how to determine and calculate taxable capital gains for a natural person and company, according to the CGT model with reference to the 8th schedule of the income tax act.

Institution

Course

Whoops! We can’t load your doc right now. Try again or contact support.

Written for

- Institution

- University of KwaZulu-Natal (UKZN)

- Course

- Taxation (ACCT341)

All documents for this subject (18)

Document information

- Uploaded on

- January 14, 2022

- Number of pages

- 10

- Written in

- 2021/2022

- Type

- Summary

Subjects

-

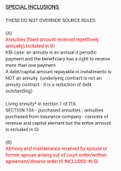

cgt

-

capital gains

-

8th schedule

-

eighth schedule

$3.18

Get access to the full document:

100% satisfaction guarantee

Immediately available after payment

Both online and in PDF

No strings attached

Get to know the seller

UKZNAccounting

Also available in package deal

Package deal

Ultimate tax 3A summary

3

7

2022

$ 22.23

More info