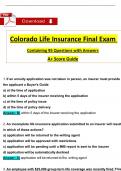

Containing 95 Questions with Answers

A+ Score Guide

1. If an annuity application was not taken in person, an insurer must provide

the applicant a Buyer's Guide

a) at the time of application

b) within 5 days of the insurer receiving the application

c) at the time of policy issue

d) at the time of policy delivery

Answer: B) within 5 days of the insurer receiving the application

2. An incomplete life insurance application submitted to an insurer will result

in which of these actions?

a) application will be returned to the writing agent

b) application will be approved with restrictions

c) application will be pending until a MIB report is sent to the insurer

d) application will be automatically declined

Answer: A) application will be returned to the writing agent

3. An employee with $25,000 group term life coverage was recently fired. This

, Answer: D) $25,000 individual whole life policy

4. When an employee is terminated, which statement about a group term life

conversion is true?

a) employee must convert group term life coverage into an individual term life

policy

b) employee must provide evidence of insurability for conversion

c) policy proceeds will be paid if the employee dies during the conversion

period

d) policy proceeds will NOT be paid if the employee dies during the conversion

period

Answer: c) policy proceeds will be paid if the employee dies during the conversion

period

5. A(n) rider may be used to include coverage for children under their

parents' life insurance policy.

a) payor

b) term

c) conversion

d) parent

Answer: B) term

6. The automatic premium loan provision is designed to

a) avoid a policy lapse

b) allow a policyowner to take out additional coverage without evidence of

insurability

c) allow a policyowner to request a policy loan

d) provide a source of revenue to the insurance company

,c) detect and deter terrorism

d) detect and deter misrepresentation

Answer: c) detect and deter terrorism

8. The part of a life insurance policy guaranteed to be true is called a(n):

a) representation

b) exclusion

c) warranty

d) waiver

Answer: c) warranty

9. G purchased a Family Income policy at age 40, The policy has a 20-year

rider period. If G were to die at age 50, how long would G's family receive an

income?

a) 5 years

b) 10 years

c) 15 years

d) 20 years

Answer: B) 10 years

10. The Consideration clause of an insurance contract includes:

a) the buyer's guide

b) a summary of the coverage provided

c) the named beneficiaries

d) the schedule and amount of premium

payments

Answer: D) the schedule and amount of premium payments

, c) 3

d) 1

Answer: B) 6

12. An producer who violates a cease and desist order may, after a hearing, be

fined up to

a) $250

b) $500

c) $750

d) $1000

Answer: B) $500

13. Which provision prevents an insurer from changing the terms of the con-

tract with the policyowner by referring to documents not found within the

policy itself?

a) policy exclusion

b) incontestable

c) entire contract provision

d) assignment

Answer: c) entire contract provision

14. Which tax would an IRA participant be subjected to on distributions re-

ceived prior to age 59 1/2?

a) 10% tax penalty for early withdrawal

b) capital gains tax

c) ordinary income tax and a 10% tax penalty for early withdrawal

d) ordinary income tax