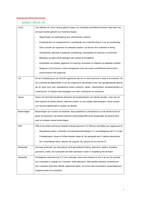

6:13(a) What is the purpose of the Equal Credit Opportunity Act? - ANSWER

The ECOA prohibits creditors from discriminating based on factors of race,

religion, marital status or age.

6:1 List positive uses of credit - ANSWER Convenience, no need to carry

cash, buy when funds are low, shop online and by phone, recordkeeping.

6:2 List negative uses of credit - ANSWER Tempting to overspend, future

income is committed to previous contracts, interest in expensive, worry and

stress about debt.

6:3 APR - ANSWER Annual rate that is charged for borrowing, expressed as a

percentage number that represents the actual yearly cost of funds over the term

of a loan.

6:4 Debt Limit - ANSWER Overall maximum you believe you should owe

based on your ability to meet repayment obligations.

6:5 Describe the criteria for obtaining credit - ANSWER 1. Be 18 years old 2.

Have a Social Security Number 3. Have a source of income 4. Have a positive

Credit History

6:6 Summarize steps to take to minimize the risks of identity theft - ANSWER

1. Don't share PINs or passwords; 2. Shred sensitive documents; 3. Put a

security freeze on your credit report; 4. Don't carry your SS card on you.

6:7 Security freeze - ANSWER Prevents a credit reporting company from

releasing your credit report to merchants and financial institutions without your

consent.

6:8 What is the purpose of a usury law? - ANSWER Prohibit lenders from

charges high rates on loans by setting caps on the maximum amount of interest

that can be levied.

The ECOA prohibits creditors from discriminating based on factors of race,

religion, marital status or age.

6:1 List positive uses of credit - ANSWER Convenience, no need to carry

cash, buy when funds are low, shop online and by phone, recordkeeping.

6:2 List negative uses of credit - ANSWER Tempting to overspend, future

income is committed to previous contracts, interest in expensive, worry and

stress about debt.

6:3 APR - ANSWER Annual rate that is charged for borrowing, expressed as a

percentage number that represents the actual yearly cost of funds over the term

of a loan.

6:4 Debt Limit - ANSWER Overall maximum you believe you should owe

based on your ability to meet repayment obligations.

6:5 Describe the criteria for obtaining credit - ANSWER 1. Be 18 years old 2.

Have a Social Security Number 3. Have a source of income 4. Have a positive

Credit History

6:6 Summarize steps to take to minimize the risks of identity theft - ANSWER

1. Don't share PINs or passwords; 2. Shred sensitive documents; 3. Put a

security freeze on your credit report; 4. Don't carry your SS card on you.

6:7 Security freeze - ANSWER Prevents a credit reporting company from

releasing your credit report to merchants and financial institutions without your

consent.

6:8 What is the purpose of a usury law? - ANSWER Prohibit lenders from

charges high rates on loans by setting caps on the maximum amount of interest

that can be levied.