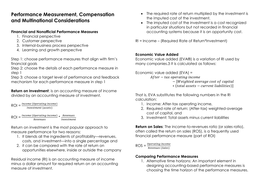

Performance Measurement, Compensation The required rate of return multiplied by the investment is

the imputed cost of the investment.

and Multinational Considerations The imputed cost of the investment is a cost recognized

in particular situations but not recorded in financial

Financial and Nonofficial Performance Measures accounting systems because it is an opportunity cost.

1. Financial perspective

2. Customer perspective RI = Income – (Required Rate of Return*Investment)

3. Internal-business process perspective

4. Learning and growth perspective

Economic Value Added

Step 1: choose performance measures that align with firm’s Economic value added (EVA®) is a variation of RI used by

financial goals many companies.3 It is calculated as follows:

Step 2: choose the details of each performance measure in

step 1 Economic value added (EVA) =

Step 3: choose a target level of performance and feedback 𝐴𝑓𝑡𝑒𝑟 − 𝑡𝑎𝑥 𝑜𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑖𝑛𝑐𝑜𝑚𝑒

mechanism for each performance measure in step 1 − [𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝑎𝑣𝑒𝑟𝑎𝑔𝑒 𝑐𝑜𝑠𝑡 𝑜𝑓 𝑐𝑎𝑝𝑖𝑡𝑎𝑙

∗ (𝑡𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠 − 𝑐𝑢𝑟𝑟𝑒𝑛𝑡 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠)]

Return on Investment: is an accounting measure of income

divided by an accounting measure of investment. That is, EVA substitutes the following numbers in the RI

calculation:

ROI =

𝐼𝑛𝑐𝑜𝑚𝑒 (𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑖𝑛𝑐𝑜𝑚𝑒) 1. Income: After-tax operating income,

𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 (𝑎𝑠𝑠𝑒𝑡𝑠) 2. Required rate of return: (After-tax) weighted-average

cost of capital, and

𝐼𝑛𝑐𝑜𝑚𝑒 (𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑖𝑛𝑐𝑜𝑚𝑒) 𝑅𝑒𝑣𝑒𝑛𝑢𝑒𝑠

ROI = * 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 3. Investment: Total assets minus current liabilities

𝑅𝑒𝑣𝑒𝑛𝑢𝑒𝑠

Return on investment is the most popular approach to Return on Sales: The income-to-revenues ratio (or sales ratio),

measure performance for two reasons: often called the return on sales (ROS), is a frequently used

1. It blends all the ingredients of profitability—revenues, financial performance measure (part of ROI)

costs, and investment—into a single percentage and

𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑖𝑛𝑐𝑜𝑚𝑒

2. it can be compared with the rate of return on ROS = 𝑅𝑒𝑣𝑒𝑛𝑢𝑒𝑠 (𝑆𝑎𝑙𝑒𝑠)

opportunities elsewhere, inside or outside the company

Comparing Performance Measures

Residual income (RI) is an accounting measure of income 1. Alternative time horizons: An important element in

minus a dollar amount for required return on an accounting designing accounting-based performance measures is

measure of investment. choosing the time horizon of the performance measures.

the imputed cost of the investment.

and Multinational Considerations The imputed cost of the investment is a cost recognized

in particular situations but not recorded in financial

Financial and Nonofficial Performance Measures accounting systems because it is an opportunity cost.

1. Financial perspective

2. Customer perspective RI = Income – (Required Rate of Return*Investment)

3. Internal-business process perspective

4. Learning and growth perspective

Economic Value Added

Step 1: choose performance measures that align with firm’s Economic value added (EVA®) is a variation of RI used by

financial goals many companies.3 It is calculated as follows:

Step 2: choose the details of each performance measure in

step 1 Economic value added (EVA) =

Step 3: choose a target level of performance and feedback 𝐴𝑓𝑡𝑒𝑟 − 𝑡𝑎𝑥 𝑜𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑖𝑛𝑐𝑜𝑚𝑒

mechanism for each performance measure in step 1 − [𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝑎𝑣𝑒𝑟𝑎𝑔𝑒 𝑐𝑜𝑠𝑡 𝑜𝑓 𝑐𝑎𝑝𝑖𝑡𝑎𝑙

∗ (𝑡𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠 − 𝑐𝑢𝑟𝑟𝑒𝑛𝑡 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠)]

Return on Investment: is an accounting measure of income

divided by an accounting measure of investment. That is, EVA substitutes the following numbers in the RI

calculation:

ROI =

𝐼𝑛𝑐𝑜𝑚𝑒 (𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑖𝑛𝑐𝑜𝑚𝑒) 1. Income: After-tax operating income,

𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 (𝑎𝑠𝑠𝑒𝑡𝑠) 2. Required rate of return: (After-tax) weighted-average

cost of capital, and

𝐼𝑛𝑐𝑜𝑚𝑒 (𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑖𝑛𝑐𝑜𝑚𝑒) 𝑅𝑒𝑣𝑒𝑛𝑢𝑒𝑠

ROI = * 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 3. Investment: Total assets minus current liabilities

𝑅𝑒𝑣𝑒𝑛𝑢𝑒𝑠

Return on investment is the most popular approach to Return on Sales: The income-to-revenues ratio (or sales ratio),

measure performance for two reasons: often called the return on sales (ROS), is a frequently used

1. It blends all the ingredients of profitability—revenues, financial performance measure (part of ROI)

costs, and investment—into a single percentage and

𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑖𝑛𝑐𝑜𝑚𝑒

2. it can be compared with the rate of return on ROS = 𝑅𝑒𝑣𝑒𝑛𝑢𝑒𝑠 (𝑆𝑎𝑙𝑒𝑠)

opportunities elsewhere, inside or outside the company

Comparing Performance Measures

Residual income (RI) is an accounting measure of income 1. Alternative time horizons: An important element in

minus a dollar amount for required return on an accounting designing accounting-based performance measures is

measure of investment. choosing the time horizon of the performance measures.