Wessel de Boer

Finance and Control Jaar 2

,Inhoudsopgave

Chapter 29 Financial Analysis ...................................................................................................................4

29.1 Understanding Financial Statements ...................................................................................................4

29.2 Measuring company performance .......................................................................................................4

29.3 Measuring Efficiency ............................................................................................................................5

29.4 Measuring leverage..............................................................................................................................6

29.5 Measuring Liquidity ..............................................................................................................................7

Chapter 30 Financial planning ..................................................................................................................8

30.2 Tracing changes in cash .......................................................................................................................8

30.5 Long term planning models and company valuation ...........................................................................8

Chapter 6 Making investment decisions with the net present value rule ..................................................9

6.1 Forecasting a Project’s Cash Flows.........................................................................................................9

Chapter 25 The many different kinds of debt..........................................................................................11

25.1 Long-term cooperate bonds ...............................................................................................................11

25.2 Convertible securities and some unusual bonds.................................................................................13

25.3 Bank Loans .........................................................................................................................................14

25.4 Commercial paper and medium-term notes ......................................................................................15

Chapter 9 Risk and the cost of capital .....................................................................................................16

9.1 Company and project costs of capital ..................................................................................................16

Chapter 8 The Capital Asset Pricing Model .............................................................................................18

8.2 the relationship between Risk and return ............................................................................................18

Chapter 13 An Overview Of Corporate Financing ....................................................................................20

13.1 Patterns of corporate financing .........................................................................................................20

13.2 Equity .................................................................................................................................................20

13.3 Debt ....................................................................................................................................................21

Chapter 5 Net present value and other investment criteria ....................................................................22

5.1 the net present value............................................................................................................................22

5.2 The payback and accounting rate of return rules ................................................................................22

5.3 The internal rate of return rule.............................................................................................................23

5.4 Choosing capital investments when resources are limited...................................................................24

Chapter 10 Project analysis ....................................................................................................................24

10.1 Sensitivity and scenario analysis ........................................................................................................24

,Chapter 3 Valuing bonds ........................................................................................................................25

3.1 Using the present value formula to value bonds ..................................................................................25

3.2 How bond prices vary with yields .........................................................................................................26

3.5 Real and nominal interest rates ...........................................................................................................26

Chapter 4 Valuing stocks ........................................................................................................................27

4.2 Valuation by comparables....................................................................................................................27

4.3 Dividends and stock prices ...................................................................................................................28

4.4 Dividend discount model applications ..................................................................................................28

Chapter 7 Introduction to Risk, Diversification, and portfolio selection ..................................................29

7.1 The relationship between risk and return ............................................................................................29

7.2 How to measure risk.............................................................................................................................30

7.3 how diversification reduces risk ...........................................................................................................32

7.4 Systematic risk is market risk ...............................................................................................................33

, Chapter 29 Financial Analysis

29.1 Understanding Financial Statements

The balance sheet

be turned into Assets are listed in declining order of liquidity. The accountant list first those assets

that are most likely to cash in the near future. Current assets are inventories of raw materials, work

in process, and finished goods. Current liabilities include debts that are due to be repaid and

payables.Net working capital is the difference between current assets and liabilities.

Net working capital = current assets – current liabilities

The Income Statement

The income statement shows how profitable the firm has been over the past year. The earnings

before interest and taxes called EBIT.

EBIT = Total revenue – costs + other income

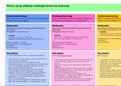

29.2 Measuring company performance

These are some financial performance measures:

Market Capitalization.

• Total market value of equity, equal to share price times number of shares outstanding.

Market capitalization = #share x price per share

Market Value Added.

• Market capitalization minus book value of equity.

MVA = Market capitalization – equity book value

Economic Value Added

• Net income minus a charge for the cost of capital employed. Also called residual income.

æ aftertax + net income ö

EVA = ç - cost of capital ÷ ´ total capital

è total capital ø

Accounting Rates of return

EVA measures how many dollars a business is earning after deducting the cost of capital. The more

assets a manager has to work with, the greater the opportunity to generate a large EVA. Smaller

companies have a few assets. Therefore, it can be helpful to measure the firm’s return per dollar of

investment.