Challenges (2010 – Sudarsanam)

(W1/2) Chapter 1: Introduction

M&A’s, by which 2 companies are combined to achieve certain strategic and business perspectives,

are transactions of great significance.

Shareholder wealth gains are usually measures by abnormal returns, i.e. returns in excess of an

appropriate benchmark return. Evidence suggests that shareholders of acquirers experience wealth loss

on average, or at best, break even. On the other hand, shareholder of target companies are better off,

with abnormal returns in the order of 20% to over 43%.

From a large sample of studies it is concluded that a high proportion of acquisitions fail to deliver their

objectives. M&A’s more often destroy, rather than enhance value for the acquirer shareholders. Thus,

M&A transactions are high-risk corporate transactions. However, patterns suggest that certain types of

acquisitions are more successful than others; for example in the UK, hostile acquisitions generate

larger wealth gains than friendly mergers.

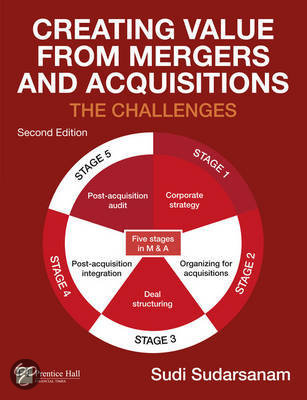

Five stage model of this book:

1. Corporate strategy development.

Business strategy is concerned with ways of achieving, maintaining or enhancing competitive

advantage in product markets. Corporate strategy is concerned with ways of optimizing the portfolio

of businesses that a firm currently owns, and with how this portfolio can be changed to serve the

interests of the corporation’s stakeholders. M&A can serve the objectives of both corporate and

business strategies.

2. Organizing for acquisitions

One of the major reasons for the observed failure of many acquisitions may be that firms lack the

organizational resources and capabilities for making acquisitions. Thus a precondition for a successful

acquisition is that the firm organizes itself for effective acquisition-making. At this stage the firm lays

down the criteria for potential targets of acquisitions consistent with the strategic objectives and value

creation logic of the firm’s corporate strategy and business model.

3. Deal structuring and negotiation

All the different things that due diligence needs to cover are on page 7. Important to read all this again

before the exam.

4. Post-acquisition integration

At this stage the objective is to put in place a merged organization that can deliver the strategic and

value expectations that drove the merger in the first place. You have to take into account:

Change of the target firm;

Change of the acquiring firm; and

, Change in the attitude and behavior of both to accommodate coexistence or fusion of the two

organizations.

The integration time is also a time of great uncertainty for the managers and the workforce; so, social

processes are at work that may seriously affect the outcome of the M&A.

Also, integration of the merging firms’ information systems (IS) is important. This is particularly

important in mergers that seek to leverage each company’s information on customers, markets or

processes with that of the other company, as in banking and insurance merger.

5. Post-acquisition audit and organizational learning

“Poor acquisitions may be a consequence of governance failure”.

(W1/2) Chapter 2: Historical overview or M&A activity

One of the striking aspects of M&A’s is that they occur in bursts interspersed with relative inactivity.

This is seen in the US for over 100 years, in the UK from the 1960’s and now also in continental

Europe.

In this chapter we first provide evidence of merger waves, and highlight the increasingly global nature

of the waves of the 1980s, the 1990s and the more recent burst of merger waves.

Merger waves at the macro level hide another pattern, namely, industry level waves or clusters.

Wave pattern of the US:

First wave: Merging for monopoly (1890-1905): Approximately 71 important oligopolistic or

near-competitive industries were converted into near monopolies by merger. Horizontal

takeovers: within the same industry/competitors.

Second wave: Merging for oligopoly (1920s): This was a much smaller wave than the first in

terms of relative impact.

Third wave: Merging for growth (1960s): The mergers in this period were not large, and did

not involve large acquirers. They were mostly unrelated mergers aimed at achieving growth

through diversification into new product markets.

Fourth wave: Late 1970s: Merger waves seemed to track the stock market level. Lots of new

developments in the M&A scene hostile tender offers etc.

Fifth wave: 1993-2000: the mother of all waves so far. Firms made acquisitions on the basis of

the need to augment their resources and capabilities in order to enhance their competitive

advantage. This wave saw the emergence of hostile tender offers, to a high degree a return to

corporations’ core businesses., and private equity firm’s LBO’s and MBO’s.

Sixth wave: Into the millennium climaxed in 2007

Wave pattern of EU

The EU member countries have experienced increasing levels of takeover activity since 1984.

Two waves; a small one during 1986-1992 and a bigger one between 1996-2002. These two

waves are parallel to those of the same period in the US.

During the 1990s purely domestic M&A, i.e. transactions involving two or more firms

registered in the same member state, accounted for the bulk of the activity.