THE EFFECT OF BONUS SCHEMES ON

ACCOUNTING DECISIONS

Healy (1985) article

Overview

Healy (1985) article.........................................................................................................................................1

Summarized .................................................................................................................... 1

Key formula ..................................................................................................................... 3

Sample design.......................................................................................................................... 3

Collection of financial data ....................................................................................................... 3

Contingency tests and results ................................................................................................... 4

Limitations of the contingency test ........................................................................................... 5

Conclusions ............................................................................................................................. 6

How I would study this, step by step procedure in my words............................................. 7

Discussion 3 Question 2B ................................................................................................. 7

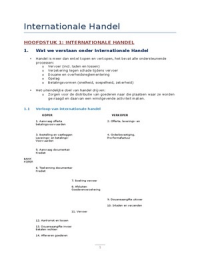

Summarized

Bonus plans:

What do you prefer as manager when your earnings without your discretionary decisions is

in region LOW, MID, or UPP?

• LOW: if close to starting bonus: try to increase earnings

• MID: increase earnings to increase bonus

• UPP: Lower earnings

Total Accruals = Non-discretionary accruals + discretionary accruals

Look at Total accruals

Limitation: not all accruals can be ‘manipulated’

Study: how do these accruals relate to the manager’s bonus plan?

1

, GO BACK BUTTON

Expectation if managing earnings:

LOW: low accruals

MID: high accruals

UPP: low accruals

The author tests the association between managers' accrual and accounting

procedure decisions and their income-reporting incentives under bonus plans. The

study examines typical bonus contracts, thus providing a complete analysis of the

effects.

The theory is tested for a sample of 94 companies.

Two classes were tested:

1) Accrual tests

2) Tests of changes in accounting procedures

Accruals are defined as the difference between reported earning and cash flows from

operations.

The author also tests whether accruals differ for companies with different bonus plan

formats.

Tests using changes in accounting procedures suggest that managers' decisions to

change procedures are not associated with bonus plan incentives. However,

additional tests do find that changes in accounting procedures are related to the

adoption or modification of a bonus plan.

Examples of accounting bonus schemes given in the article are: deferred salary

payment, insurance plans, non-qualified stock options, restricted stock, stock

2