Fiscal law Guides d'étude, Notes de cours & Résumés

Vous recherchez les meilleurs guides d'étude, notes d'étude et résumés sur Fiscal law ? Sur cette page, vous trouverez 2524 documents pour vous aider à réviser pour Fiscal law.

All 2.524 résultats

Trier par

Très apprécié

Très apprécié

-

Test Bank For Accounting for Governmental & Nonprofit Entities Jacqueline Reck 18th Ed

- Examen • 533 pages • 2023

-

- $32.25

- 3x vendu

- + en savoir plus

Accounting for Governmental and Nonprofit Entities, 18e (Reck) Chapter 3 Governmental Operating Statement Accounts; Budgetary Accounting 1) The government-wide statement of net position displays the net expense or revenue for each function or program of the government. Answer: FALSE Difficulty: 1 Easy Topic: Reporting of expenses and revenues at the government-wide level Learning Objective: 03-01 Describe how operating revenues and expenses related to governmental activities are reported i...

Très apprécié

Très apprécié

-

CLG 001_ Fiscal Law Exam version 2/ with 100% 2024 verified answers

- Examen • 20 pages • 2023 Très apprécié

-

- $8.49

- 2x vendu

- + en savoir plus

QUESTION 1 1. Which of the following is a correct statement of Fiscal Law Philosophy: If the law is silent as to whether a purchase can be made, it is probably safe to spend appropriated funds. authorized by Congress. If the commander says buy it, don’t worry about Fiscal Law Regulations. Absent a specific prohibition, expending appropriated funds is permitted. 20 points QUESTION 2 1. It is July 2010. The contracting officer at Fort Mason is about to award a contract for a comput...

-

Fiscal Law Final Exam QUESTIONS AND ANSWERS RATED A+ 2023|2024 UPDATE

- Examen • 17 pages • 2023

-

- $10.49

- 1x vendu

- + en savoir plus

This study source was downloaded by from CourseH on :15:29 GMT -06:00 Fiscal Law Final Exam QUESTIONS AND ANSWERS RATED A+ 2023|2024 UPDATE QUESTION 1 1. It is appropriate for the Army to acquire lawn cutting services through the Project Order Statute. True False QUESTION 2 1. The proper amount of money to obligate at the award of a firm fixed- price contract is: The full amount of the contract. Nothing until the contractor performs the required work. Half of the total liability. ...

-

Fiscal Law Test Questions with Correct Answers

- Examen • 5 pages • 2024

-

Disponible en pack

-

- $11.99

- 1x vendu

- + en savoir plus

Fiscal Law Test Questions with Correct Answers Fiscal Law - ANSWER Body of law governing use of federal funds Fiscal Year - ANSWER 1 October ‐ 30 September Period of Availability - ANSWER Most appropriations available for obligation for limited time period Funds not obligated in timely manner generally expire Obligation - ANSWER Transaction legally binding the government to make payment E.g., place an order, award a contract, receive services Budget Authority - ANSWER Federal law p...

-

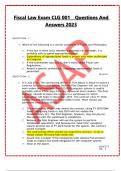

Fiscal Law Exam CLG 001 _ Questions And Answers 2023

- Examen • 13 pages • 2023

-

- $15.49

- 1x vendu

- + en savoir plus

Fiscal Law Exam CLG 001 _ Questions And Answers 2023 QUESTION 1 1. Which of the following is a correct statement of Fiscal Law Philosophy: If the law is silent as to whether a purchase can be made, it is probably safe to spend appropriated funds. Expenditure of appropriated funds is proper only when authorized by Congress. If the commander says buy it, don’t worry about Fiscal Law Regulations. Absent a specific prohibition, expending appropriated funds is ...

-

FISCAL LAW FINAL EXAM QUESTIONS AND ANSWERS

- Examen • 9 pages • 2022

-

- $10.99

- 2x vendu

- + en savoir plus

QUE ST ION 1 1. It is appropriate for the Army to acquire lawn cutting services through the Project Order Statute. True False 4 points QUE ST ION 2 1. The proper amount of money to obligate at the award of a firm fixedprice contract is: The full amount of the contract. Nothing until the contractor performs the required work. Half of the total liability. A conservative amount based on the government’s estimated future requirements. 4 points QUE ST ION 3 1. How long does the Depar...

-

NEW - 2021 Comptrollers Accreditation and Fiscal Law Course Class 001 (Army Fiscal Law)

- Examen • 4 pages • 2023

- Disponible en pack

-

- $8.99

- 1x vendu

- + en savoir plus

NEW - 2021 Comptrollers Accreditation and Fiscal Law Course Class 001 (Army Fiscal Law)

-

Fiscal Law Final Exam answered- spring 2022.

- Autre • 9 pages • 2022

-

Disponible en pack

-

- $10.29

- 8x vendu

- + en savoir plus

Fiscal Law Final Exam QUESTION 1 1. It is appropriate for the Army to acquire lawn cutting services through the Project Order Statute. True False QUESTION 2 1. The proper amount of money to obligate at the award of a firm fixedprice contract is: The full amount of the contract. Nothing until the contractor performs the required work. Half of the total liability. A conservative amount based on the government’s estimated future requirements. QUESTION 3 1. How long does the Departme...

VALUE PACK:: FISCAL LAW EXAMS QUESTIONS AND ANSWERS 2023

-

CDFM EXAM (4 DIFFERENT SUB MODULE 3.1 - 3.4) QUESTIONS AND CORRECT ANSWERS EACH SUB MODULE CONTAINS 100 QUESTIONS AND ANSWERS LATEST 2023-2024

- Examen • 61 pages • 2023

-

- $16.99

- 1x vendu

- + en savoir plus

CDFM EXAM (4 DIFFERENT SUB MODULE 3.1 - 3.4) QUESTIONS AND CORRECT ANSWERS EACH SUB MODULE CONTAINS 100 QUESTIONS AND ANSWERS LATEST 2023-2024 What is the basic axiom of Fiscal Law? - ANSWER- The established rule is that the expenditure of public funds is proper only when authorized by Congress, not that public funds may be expended unless prohibited by Congress. U.S. vs McCollum (1976) "Where can the most authoritative source of information on the proper use of appropriated funds be...

-

Fiscal Law- Exam Questions and Answers

- Examen • 5 pages • 2022

-

- $9.99

- 1x vendu

- + en savoir plus

Fiscal Law - ANSWER Body of law governing use of federal funds Fiscal Year - ANSWER 1 October ‐ 30 September Period of Availability - ANSWER Most appropriations available for obligation for limited time period Funds not obligated in timely manner generally expire Obligation - ANSWER Transaction legally binding the government to make payment E.g., place an order, award a contract, receive services Budget Authority - ANSWER Federal law provides to incur obligations up to specifie...

Stress d'étude? Pour les vendeurs sur Stuvia, c'est en fait une époque dorée. KA-CHING ! Gagnez aussi de vos résumés et commencez à télécharger dès maintenant. Découvrez tout sur gagner de l'argent sur Stuvia