Accounting 3100 Study guides, Class notes & Summaries

Looking for the best study guides, study notes and summaries about Accounting 3100? On this page you'll find 20 study documents about Accounting 3100.

All 20 results

Sort by

-

ACCOUNTING 3100, Final Exam, Baruch College, CUNY.

- Exam (elaborations) • 10 pages • 2023

-

- $8.89

- + learn more

ACC 3100 Final Exam – Version A A Stan Ross Department of Accountancy, Baruch College ACCOUNTING 3100, Final Exam, Spring 2017 Name: Last 4 Digits of SSN: Exam Number: Provide your numerical ans wers in the spaces provided on this exam. Show all your workings (partial credit is awarded for correct but incomplete answers). For correct answers, you must show all your supporting calculations/explanations. All supporting calculations and schedules must be legible and in good form. Be neat with you...

-

ACC 3100 Baruch College, CUNY. MIDTERM REVIEW. All Worked Solutions

- Exam (elaborations) • 12 pages • 2023

-

- $18.99

- 1x sold

- + learn more

ACC 3100 Baruch College, CUNY. MIDTERM REVIEW. All Worked Solutions 1. ABC declared a property dividend. The dividend consisted of 12,000 common shares of its investment in XYZ Company. The shares h ad originally been purchased at $2 per share and had a $1 par. The value of the shares on the declaration date is $8 per share. What is the first entry that should be recorded related to this dividend? 2. Roberto Corporation was organized on January 1, 2021. The firm was authorized to issue 83,000 sh...

-

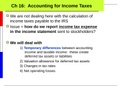

ACCT 3100 Fin Acc - Baruch College_ Ch 16: Accounting for Income Taxes-Deferred Tax Assets/Liabilities, pre-tax accounting income and taxable income, Deferred Tax Liabilities/Assets, Valuation Allowance, Tax rate, and Net Operating Losses (NOL)

- Class notes • 23 pages • 2023

-

- $9.99

- + learn more

ACCT 3100 Fin Acc - Baruch College_ Ch 16: Accounting for Income Taxes-Deferred Tax Assets/Liabilities, pre-tax accounting income and taxable income, Deferred Tax Liabilities/Assets, Valuation Allowance, Tax rate, and Net Operating Losses (NOL)

-

ACC 3100 – Financial Accounting II Midterm 1 - Review. Baruch College. Topics covered: Long-Term Debt, Stockholders Equity, Share-Based Compensation, Earnings Per Share, Time Value of Money and Leases. Questions and Solutions

- Exam (elaborations) • 23 pages • 2023

-

- $13.99

- + learn more

ACC 3100 – Financial Accounting II Midterm 1 - Review. Baruch College. Topics covered: Long-Term Debt, Stockholders Equity, Share-Based Compensation, Earnings Per Share, Time Value of Money and Leases. Questions and Solutions

-

NASCLA Contractors Guide Arkansas 5th edition Exam Questions with Correct Answers

- Exam (elaborations) • 30 pages • 2024

- Available in package deal

-

- $10.49

- + learn more

NASCLA Contractors Guide Arkansas 5th edition Exam Questions with Correct Answers 2 - answerHow many members of the board are consumers? right to work - answerwhat laws secure the right of employees to decide if they wish to support or join a union? Consideration - answer__________ is anything of value Social Security Card - answerwhich of the following establishes an employee's eligibility to leagally work in the united states? foul language - answerwhich of the following should not be tolerat...

-

ACC 3100 Financial Accounting 1 - Baruch College Campus_ACC 3100 Financial Accounting 1 -Sample Final Exam MCQ Plus Worked Solutions

- Exam (elaborations) • 7 pages • 2023

-

- $9.99

- + learn more

ACC 3100 Financial Accounting 1 - Baruch College Campus_ACC 3100 Financial Accounting 1 -Sample Final Exam MCQ Plus Worked Solutions Woody Corp. had taxable income of $8,000 in the current year. The amount of MACRS depreciation was $3,000 while the amount of depreciation reported in the income statement was $1,000. Assuming no other differences between tax and accounting income, Woody's pretax accounting income was: A. $5,000 B. $6,000 C. $10,000 D. $11,000 E. None of the above is correct. 2. K...

-

NASCLA Contractors Guide Arkansas 5th edition Exam Questions with Correct Answers

- Exam (elaborations) • 13 pages • 2024

- Available in package deal

-

- $12.49

- + learn more

NASCLA Contractors Guide Arkansas 5th edition Exam Questions with Correct Answers 2 - answerHow many members of the board are consumers? right to work - answerwhat laws secure the right of employees to decide if they wish to support or join a union? Consideration - answer__________ is anything of value Social Security Card - answerwhich of the following establishes an employee's eligibility to leagally work in the united states? foul language - answerwhich of the following should not b...

-

CISA Domain 2 Exam 183 Questions with Verified Answers,100% CORRECT

- Exam (elaborations) • 49 pages • 2024

-

- $12.49

- + learn more

CISA Domain 2 Exam 183 Questions with Verified Answers IT management - CORRECT ANSWER the process of managing activities related to information technology operations and resources, which helps ensure that IT continues to support the defined enterprise objectives IT resource management - CORRECT ANSWER the process of pre-planning, scheduling and allocating the limited IT resources to maximize efficiency in achieving the enterprise objectives - When an organization invests its resources in...

-

CPP Certified Payroll Professional Exam 140 Questions with Verified Answers 2019 ,100% CORRECT

- Exam (elaborations) • 17 pages • 2024

-

- $11.49

- + learn more

CPP Certified Payroll Professional Exam 140 Questions with Verified Answers 2019 Counseling is appropriate when: a. salaries have been frozen. b. introducing a new procedure. c. explaining tax law changes. d. orienting new employees. - CORRECT ANSWER a. salaries have been frozen. In addition to the accuracy-related penalty for underpayment of taxes, if the underpayment of taxes is due to fraud, the IRS may asses an additional penalty of: - CORRECT ANSWER 75% If an employer's total...

-

CISA Domain 2 Exam 100 Questions with Verified Answers,100% CORRECT

- Exam (elaborations) • 16 pages • 2024

-

- $11.49

- + learn more

CISA Domain 2 Exam 100 Questions with Verified Answers What does EGIT stand for? What is it's meaning? - CORRECT ANSWER Enterprise Governance of Information and Technology. It a system composed of stakeholders, board of directors, department managers, and internal customers who provide input into the IT decision making process. What are the three broad processes in the EGIT framework are: - CORRECT ANSWER 1. IT Resource Management - Focuses on maintainng an updated inventory of all IT res...

Do you wonder why so many students wear nice clothes, have money to spare and enjoy tons of free time? Well, they sell on Stuvia! Imagine your study notes being downloaded a dozen times for $15 each. Every. Single. Day. Discover all about earning on Stuvia