Tax accounting i Study guides, Class notes & Summaries

Looking for the best study guides, study notes and summaries about Tax accounting i? On this page you'll find 1256 study documents about Tax accounting i.

Page 4 out of 1.256 results

Sort by

-

Test Bank for Intermediate Financial Management, 14th Edition by Eugene F. Brigham

- Exam (elaborations) • 581 pages • 2022

-

- $39.49

- 2x sold

- + learn more

Test Bank for Intermediate Financial Management 14e 14th Edition by Eugene F. Brigham, Phillip R. Daves. ISBN-13: 6775 Full Chapters test bank included Part I: FUNDAMENTAL CONCEPTS. 1. An Overview of Financial Management. Web Extension 1A: An Overview of Derivatives. Web Extension 1B: A Closer Look at the Stock Markets. 2. Risk and Return: Part I. Web Extension 2A: Continuous Probability Distributions. Web Extension 2B: Estimating Beta with a Financial Calculator. 3. Risk and Return: Pa...

-

TEST BANK for International Financial Management 10th Edition by Cheol Eun, Bruce Resnick and Tuugi Chuluun. ISBN13: 9781260013870

- Exam (elaborations) • 243 pages • 2024

-

- $30.49

- 2x sold

- + learn more

What major dimension sets apart international finance from domestic finance? A) Foreign exchange and political risks B) Market imperfections C) Expanded opportunity set D) all of the options 2) An example(s) of a political risk is A) expropriation of assets. B) adverse change in tax rules. C) the opposition party being elected. D) both the expropriation of assets and adverse changes in tax rules are correct. 3) Production of goods and services has become globalized to a large extent as...

-

CFA ESG - Mock Exam Qestions With Verified Answers

- Exam (elaborations) • 59 pages • 2023

- Available in package deal

-

- $12.99

- 1x sold

- + learn more

Which of the following is a governance issue? A. Tax transparency B. Health and safety C. Working conditions - Answer A is correct because "[e]xamples of the definition and scope of ESG issues can be illustrated by the two widely-referenced organisations...Tax Transparency [falls under the umbrella of] Governance". B is incorrect because "[e]xamples of the definition and scope of ESG issues can be illustrated by the two widely-referenced organisations...Health & Safety [falls under th...

-

TEST BANK for Canadian Income Taxation Planning and Decision Making, 25th Edition by William Buckwold, Joan Kitunen, Matthew Roman, Abraham Iqbal, ISBN-1260326837. All Chapters 1-23. (Complete Download)

- Exam (elaborations) • 229 pages • 2023

-

- $14.90

- 1x sold

- + learn more

TEST BANK for Canadian Income Taxation Planning and Decision Making, 25th Edition by William Buckwold, Joan Kitunen, Matthew Roman, Abraham Iqbal, ISBN-7. All Chapters 1-23. (Complete Download) Version 1 1 CHAPTER 1 1) Which of the following is not considered to be a separate entity for tax purposes in Canada? A) An individual B) A proprietorship C) A corporation D) A trust 2) Which of the following attitudes and actions is most likely to help decision-makers develop an efficient app...

-

CFM 445 Midterm Questions and Answers 100% Pass

- Exam (elaborations) • 16 pages • 2023

-

Available in package deal

-

- $9.99

- 1x sold

- + learn more

CFM 445 Midterm Questions and Answers 100% Pass Most companies fail when they have to face ____ or more risks at the same time 2 _____ is the most common element among contractors who fail significant increase in the size of projects undertaken Events leading to contractor failure usually take place in _______ during profitable years prior to failure T/F Past success is a good indication of future success False T/F A board of directors should be made up of internal and external members True ...

-

Solution Manual for Intermediate Accounting 18th Edition, by Donald E. Kieso, Jerry J. Weygandt and Terry D. Warfield .Chapter 1- 23 | Complete Guide A+

- Exam (elaborations) • 1977 pages • 2024

-

- $11.49

- 1x sold

- + learn more

Copyright © 2022 WILEY Kieso, Intermediate Accounting, 18/e, Solutions Manual (For Instructor Use Only) 5-1-1 Complete Solution Manual and Instructor Resource for Intermediate Accounting, 18th Edition 18th Edition, by Donald E. Kieso, Jerry J. Weygandt and Terry D. Warfield. ISBN- Chapter 1 Financial Accounting and Accounting Standards Assignment Classification Table (By Topic) Topics Questions Brief Exercises Exercises Critical Thinking 1. Environment of accounting, principles, objectives, sta...

-

Management and Cost Accounting 11Ed. by Colin Drury. COMPLETE, Elaborated and latest Test Bank ALL Chapters (1-26) included with 728 pages of questions.

- Exam (elaborations) • 731 pages • 2023

-

- $41.49

- 1x sold

- + learn more

Management and Cost Accounting 11Ed. by Colin Drury. COMPLETE, Elaborated and latest Test Bank ALL Chapters (1-26) included with 728 pages of questions. COMPLETE - Elaborated Test Bank for Management and Cost Accounting 11Ed. by Colin Drury.ALL Chapters (1-26)included with 728 pages of questions. TABLE OF CONTENTS Part I: Introduction to management and cost accounting 1. Introduction to management accounting 2. An introduction to cost terms and concepts Part II: Cost accumulation for i...

-

Solution Manual for Intermediate Accounting 18th Edition, by Donald E. Kieso, Jerry J. Weygandt and Terry D. Warfield .Chapter 1- 23 | Complete Guide A+

- Exam (elaborations) • 1977 pages • 2024

-

- $9.49

- 1x sold

- + learn more

Copyright © 2022 WILEY Kieso, Intermediate Accounting, 18/e, Solutions Manual (For Instructor Use Only) 5-1-1 Complete Solution Manual and Instructor Resource for Intermediate Accounting, 18th Edition 18th Edition, by Donald E. Kieso, Jerry J. Weygandt and Terry D. Warfield. ISBN- Chapter 1 Financial Accounting and Accounting Standards Assignment Classification Table (By Topic) Topics Questions Brief Exercises Exercises Critical Thinking 1. Environment of accounting, principles, objectives, sta...

-

CLFP-Terms Exam with 100% Correct Answers 2023

- Exam (elaborations) • 4 pages • 2023

-

- $11.49

- 1x sold

- + learn more

Equipment Lease - Correct answer-A transaction in which use and posession but not title to tangible property, is transfered for consideration. Section 38 Property - Correct answer-IRS (tax) defines personal property that can be leased as depreciable property. Third Party Leasing - Correct answer-Unrelated Maufacturer, Dealer or Broker, the independent lessor and the lessee. Balance sheet (Op Lease) - Correct answer-Includes Assets C ash A sset T otal assets Liabilities S ecurity dep...

-

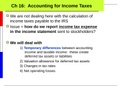

ACCT 3100 Fin Acc - Baruch College_ Ch 16: Accounting for Income Taxes-Deferred Tax Assets/Liabilities, pre-tax accounting income and taxable income, Deferred Tax Liabilities/Assets, Valuation Allowance, Tax rate, and Net Operating Losses (NOL)

- Class notes • 23 pages • 2023

-

- $9.99

- + learn more

ACCT 3100 Fin Acc - Baruch College_ Ch 16: Accounting for Income Taxes-Deferred Tax Assets/Liabilities, pre-tax accounting income and taxable income, Deferred Tax Liabilities/Assets, Valuation Allowance, Tax rate, and Net Operating Losses (NOL)

Do you wonder why so many students wear nice clothes, have money to spare and enjoy tons of free time? Well, they sell on Stuvia! Imagine your study notes being downloaded a dozen times for $15 each. Every. Single. Day. Discover all about earning on Stuvia