You searched for:

University of KwaZulu-Natal

[NGN] ATI RN COMPREHENSIVE 2023!!! ATI COMPREHENS

10th Grade

11th Grade

123 University

12th Grade

13F Slc Cde

180 Hour Level 5 Certificate

180 hour TEFL course

2023 / 2024 RN HESI EXAM VERSION 1 ALL 160 QU

2023 / 2024 RN HESI EXIT EXAM VERSION 3 ALL

2023 Nj core pest control exam study guide 190 QUE

2023 NR 503 Final Study Guide , Final E

2023 NR 509 Final Exam Questions andCorrect Answer

2024 APEA 3P

2024 APEA 3P MIDTERM EXAM

2024 APEA 3P MIDTERM EXAM WITH 75

2024 ATI CMS FUNDAMENTAL EXAM WITH RATIONALE

2024 ATI PN COMPREHENSIVE PREDICTOR RETAKE

2024 ATI RN MATERNAL NEWBORN PROCTORED 2023 FINAL

2024 NREMT Paramedic Exams Questions and Verified

2024 REAL APEA 3P

300 hour TEFL course

420 hOUR TEFL Course- Advanced Level 5

5th Dimension College of Visual Arts

7th Grade

8th Grade

98225 HCERT BAN

9th Grade

A Level Afrikaans

A Level History

AAA Food manager certification

AAA School of Advertising

AAAE CM FINAL EXAM 2023-2024 REAL EXAM QUESTIONS

Abbotsford Christian School, East London, Eastern Cape

Abbott\'s College

Abbott\\\'s College

ABG II 452

Academic writing

academy for Christian education

ACC 701

ACCA

Accounting

Accounting 1

Accounting science

Ace Institute of Management

achieve and record management

Acsess Business Academy

Admantia Hoërskool, Kimberley, Noord Kaap

AED3701

AED3701 ASSESSMENT 03

AFK2604

AFL2601

AFL2602

african philosophy

Afrikaans first additional language

Afrikaanse Hoër Meisieskool Pretoria

Afrikaanse Hoërskool Kroonstad

AGRI 482: CROPPING SYSTEMS

agricultural science

agriculture

AIL

AIN2601

Ain2601 Assignment 1

AIN2601 Practical Accounting Data Processing

AIN2601 PRACTICAL DATA PROCESSING SEMESTERS 1 & 2.

AIN3701

AIN3701 LEARNING UNIT 5 DATA ANALYTICS

AIS2601

AIS3703

AL FALAAH COLLEGE

Al-Asr Educatinal Institute

Alexandra High School

Algebra

all

Alma Mater International School, Krugersdorp, Gauteng

ALS\\\\ACLS-RED CROSS FINAL EXAM

anatomy

anatomy & physiology

anatomy and physiology

Anchor Christian Academy, Olympus, Pretoria, Gauteng

Animal breeding and genetics 452

Animal Farm

Animal Sciences

Animal traction

ANTHROPOLOGY

Anti-Corruption and Commercial Crime Investigation

Antioch University-Los Angeles

AP GOVERNMENT

APC1501 - Political Evolution of the African State

APCT5111

APEA 3P

APEA 3P PREP-GL EXAM

APEA 3P TEST BANK

AQA

AQA A LEVEL BIOLOGY Paper 2 MS 2021

AQA A LEVEL PHYSICS 7408/3A PP3 MS

AQA A Level PHYSICS Paper 2 2020

AQA GCSE BIOLOGY Higher Tier Paper 1H 2023

AQE Private College, Pretoria, Gauteng

ARDMS SPI

ARH2601

Art Grade 7

Articles of Clerkship

asdkjsakldjaskldj

Ashford High School

Ashton International College, Benoni, Gauteng

ASSESOR COURSE

Assignment

ASSIGNMENT 02 LPL4802 2019 1 100% pass

Assignment 1 - VOCAB i-to-i

Assignment 1 for Level 5 300 Hour Online TEFL Diploma or 180 hour i-to-i TEFL course. PASSED with GR

ASSIGNMENT CONVEYANCING 02 LPL4802 2022 S2

ATI

ATI COMPREHENSIVE EXIT EXAM RETAKE 2023 WITH NGN

ATI EXIT RN Comprehensive Predictor Exam With NGN

ATI FUNDAMENTALS

ATI NGN RN Nursing Care of Children Proctored Exam

ATI PHARMACOLOGY

ATI RN COMPREHENSIVE

ATI RN COMPREHENSIVE PREDICTOR RETAKE 2019

ATI RN COMPREHENSIVE PREDICTOR RETAKE 2019

ATI RN COMPREHENSIVE RETAKE 2019 WITH NGN EXAM

ATI RN CONCEPT BASED ASSESSMENT LEVEL 1 PROCTORED

ATI RN FUNDAMENTALS PROCTORED EXAM WITH COMPLETE U

ATI-PN-PHARMACOLOGY

ATLS-POST AND PRE TEST COMPLETED exam questions wi

ATN CHN ADN210 TRACH NCLEX PRACTICE QUESTIONS

Attorneys Admission Exams

Attorneys Admission Exams - Board Exams

Auckland Park Academy of Excellence, Johannesburg, Gauteng

auditing

AUDITING 300/BCTA ASSESSMENT OPPORTUNITY 3

Aue1601

Aue1601 Exam Q&A

AUE2601

AUE2602 Corporate Governance in Accountancy

Aui2601

Australian National University

AWS cloud

B Criminology

B Ed

BA Communication Science

BA, philosophy, political and economics

Bachelor in Accounting

Bachelor of Applied Social Science - Psychology

Bachelor of education

bachelor of education degree

Bachelor of Nursing

Bachelor of Physiotherapy

bachelor of science

Baptist Theological College of Southern Africa

Basic Geriatric Nursing

BASIC NUMERACY

Basics in teaching English poetry and literature

BC

BCOM

BCom Business Management

Bcom HR

Bcom in Business administration

BCom in Financial Planning

Bcom in international business

Bcom in supply chain management

BCom Law BCom accounting Saftey Management

BCom Transport and Logistics

Beaulieu College

bED

BED in foundation phase

Benoni High School

Bergvliet High

best choice academy

BIOD 151.

BIOL 235

Biologie

Biology

Biology 400 UVic

Biology Characteristics of living organism

BIOMEDICAL ENGINEERING

Bishops - Diocesan College, Rondebosch

black people

blockchain and crypto ecosystems

BMI2607

Bmt

BNU1501

BNU1501 ASSESSMENT 3- SEMESTER 1 2024

BNU1501 S1 ASSESSMENT 3

Board Exams for Law Practioners

Body Treatments

Boston City Campus and Business College

Botany 111

BPT1501

Brainline

brainline distance education

Brainline Home School System

brainline learing world

Brainline Learning World

Brescia House High School

Brescia House School

Bridge House School

Brighnas Tuition Center

British International College

brooklyn college

Bryanston High School

BTE2601

Buissness

Burgersdorp Hoërskool, Burgersdorp, Eastern Cape

BURNS’ PRIMARY CARE PEDIATRIC 7TH EDITION

BUS ADM 451

business administration

BUSINESS ADMINISTRATION:PEOPLE MANAGEMENT I ASSIGN

Business Communication

business communications

Business enterprise law

business law and accounting control

Business Literacy

Business Management Training College

Business studies Gr 11-12

BUSL-ICB

BUSL6212

C & N Sekondêre Meisieskool, Oranje

C.S.C.S

C724

California State University Fullerton

Cambridge

Cambridge A Level History

Cambridge IGSCE

Cambridge International AS & A Level Chemistry

Cambridge International Examinations

Cannons Creek Independent School, Pinelands, Western Cape

Cape Peninsula University of Technology

CAPS

CAPS curriculum

CAPS FET Phase

CCA

CEA , CEM Rev1

Cedar house

Central Johannesburg College

Central University of Technology

Centurion Akademie

Centurion Hoërskool, Centurion, Gauteng

Centurion Remedial School, Centurion, Gauteng

Chamberlain College Nursing

Chamberlain College Of Nursing

Chamberlain College Of Nursng

Chamberlain School

Chapter 1: What is Psychology and Why Should I Car

Chartered Secretaries

Charterhouse School

CHE1501

CHE1502 Assignment 01

Chemie graad 10 opsommings

chl

CHL2601

CHL2601 Assignment 14 S2 2022

CHN COMPRE ATI COMMUNITY HEALTH PROCTORED EXAM 20

CHN COMPRE/ATI COMMUNITY HEALTH PROCTORED EXAM 20

CHN LEC COMBINED QUIZZE

CHN(ATI COMMUNITY HEALTH PROCTORED EXAM 2019 (LA

CIC 2601

cic2601

CIMA & ACCA & ICB

CIMA E1

CityVarsity

CIVICS

Civil engineering

Civil Procedure

CIVIL PROCEDURE 2022 EXAM PACK

cla

CLA1501 Commercial Law

CLA1501: Commercial Law

Cla1503 assignment 1 & 2

Clarendon High School

CLAYTON’S BASIC PHARMACOLOGY .

CLG_0010

Clifton School, Durban, KwaZulu Natal

clinical medicine

CLS2601 LAW

CMH Lahore Medical College

CMIT ACTUAL EXAM WITH 200 CORRECT VERIFIED ANSWER

CML1501

cmy

CMY2603 ASSIGNMENT 1 SEMESTER 2.

CMY3705 ASSIGNMENT 1 SEMESTER 1 OF 2022

College

Collegiate Girls High School, Port Elizabeth, Eastern Province

COM2603 ASSIGNMENT 1 SEMESTER 2 2023.

COM2603 EXAM PACK 2022

COM3701

COM3706

COM4805

Com4809

Communication Science

Comprehensive ESL Conversation Lesson Plans

Computer Science

Computer Skills in Office and Windows

conveyancin

CONVEYANCING

Cornerstone College, Pretoria, Gauteng

Cornerstone Institute

Corporate Governance in Accountancy

CORPORATE STRATEGY

COS 1512 ASSIGNMENT 3 2023.]

COS1511

COS1511 Assignment 2 2022

Cosmetology

Counselling in Loss

Craighall College, Risidale, Johannesburg, Gauteng

Crawford Schools

Creston College

criminal law

CRUMPLE ZONES GIZMOS

CSET 3707

CSP 2601 ASSIGNMENT 4. CSP2601 Assignment 4

CSP 2601. TL 102 ASSIGNMENT 2023.

CSP2601

CSP2601 Assignment 4 Semester 2

CSP2601 Assignment 4 Semester 2 (Due 29 August2023

CSP2601 ASSIGNMENT 5 2023

CSX Conductor

CTU Training Solutions

Cullinan Gekombineerde Skool/Combined School, Cullinan, Gauteng

Cumberland University

Curro Century City High School

Curro Nelspruit

Curro Private School

cus 3701

CUS3701

CUS3701-Exam

CV Template Style A

CV Template Style B

CV Template Style C

CV Template Style D

CV Template Style E

Dainfern College

Dale College

Damelin

DATA ANALYSIS AND DECISION MAKING 4TH EDITION BY S

dAV34

De la Salle Holy Cross College

DEB/CAPS

DELF A1

DEPARTMENT OF ACCOUNTANCY AUDITING 300/BCTA

DEPARTMENT OF ACCOUNTANCY AUDITING 300/BCTA 2024

Deustche Internationale Schule Johannesburg

Deutsche Internationale Schule Johannesburg

Deutsche Internationale Schule Kapstadt

Developmental psychology B

Developmental Studies

dfff

Die Anker Hoërskool / High School

Differentiated Instruction

Digital Marketing

Dinamika Hoërskool, Alberton, Gauteng

Diocesan School for Girls

Diocesan School for Girls , Grahamstown, Eastern Cape

Diploma in HRM

Diploma in policing

Diploma in security management

DLR320

DMV PERMIT TESTS

DOPR3704 ASSIGNMENT 1 2023

DPR1506 2023 EXAM SUP

DPR2603 ASSIGNMENT NUMBER 2

DPR2605 ASSIGNMENT 1 2023

DPR3702

DPR3702 ASSIGNMENT 1 SEMESTER 2DUE 11 AUGUST 2023

Dsc1520

dsc1601

DSC1630

DSC1630 ASSESSMENT 3 ANSWERS - SEMESTER 1 2024

DSC1630 ASSIGNMENT 2

DSC1630 Introductory Financial Mathematics

Dundee High School, Dundee, KZN

Durban Girls\' College

Durban Girls\' High School

Durban Girls\\\' High School

Durban High School

Durban University of Technology

DVA 2603 HONOURS

dva26

dva2601

dva35

dva36

DVA3703 DEVELOPMEMT POLICY AND STRATEGIES

dva3705

Early childhood development

earson Edexcel Business IAS Complete Revision Note

East Rand School of the Arts, Gauteng

EBW Grade 10

Economic and Financial Sciences

Economic and management research

Economical strategies

ECONOMICS

Economics 1500 - ECS1500

Economics and management science

ecs12

ecs15

Ecs1500

Ecs1501

ECS1501 - Economics

Ecs1601

Ecs1601 Assignment 4 Semester 2 2023

ECS1601 TE

ECS2601

ECS2601 - Microeconomics

ECS2604

ECS3701

Ecs3702

ECT2601

Edelman: Health Promotion Throughout the Life Span

Edenvale High School

EDL3703

EDS3701

EDT1601

Education

Education in foundation phase

El Shaddai Christian School

Elandspark School

Electrical Engineering

Electrical knowledge

Electrical Trade theory N1

Elkanah House

Elkanah House High School

EMA1501

Embury College

eml

energy exam

eng

ENG 2603

ENG RAC401M

ENG15

ENG1501

ENG1501 Assignment 3

eng1502

ENG1503

ENG1503 ASSIGNMENT 1 2023

ENG1514

ENG1516

ENG2601

Eng2603 Assignment 1 2021

ENG2611

ENG2611 Supplementary Portfolio Exam 2023

ENG2613

ENG3701

ENG3702

engineering

English

English Americanah

English language

enige skool wat die kabv-kurrikulum volg.

ENN 1504

ENN1504

Entrepreneurship

EPIC CLN 251-252 EXAM QUESTIONS AND 100% CORRECT A

EPP2601

Epworth School

ERT45

ESC 3701

Essentials of Psychiatric Mental Health Nursing 9t

ETA

ETH302S

Ethics in counselling

EUP1501

EUP1501 Portfolio Exam

Exam 2022

FAC 1502 - FINANCIAL ACCOUNTING

FAC 1502 Assignment 1 semester 1 2024

FAC 1602 ASSIGNMENT 4

FAC1502

FAC1502 ASSESSMENT 2 2024 memo

FAC1601

FAC1601 Assignment 2 Second Semester 2022

FAC1602

FAC2601

FAC2601 - Financial Accounting for Companies

FAC2601 UPDATED LATEST 2023 Exam Pack (Questions a

FAC2602

fac2602 assighnment 1&2

Fac2602 assignment 2 simester 1

FAC3702

FAC3764

FAC3764 ASSIGNMENT

Fairmont High School

Family Law

FCLE/FLORIDA CIVIC LITERACY EXAM, PRACTICE

FDR67

FEEDBACK AND ANSWERS ASSIGNMENT 02

FEEDBACK FOR ASSIGNMENT 8 DISTINCTION GUARANTEED 2

FEEDBACK for assignment 8-1 215 guarnteed pass 202

Feedbacon Assignment 2 due date 6th November exam

FIN2601

FIN3702 Assignment 2 Semester 2 - 2023

Finance and accounting

FINANCIAL ACCOUNTING

Financial Accounting Concepts, Principles and Procedures

Financial Management

Financial Reporting and Analysis

Financial Service Conduct Authority

Financial Statement-ICB

FINANCIAL STATEMENTS-ICB

FMT3701

food and nutrition

Food Manager

Food safety Level 2

food science and technology

Forensic Psychology

FOUNDATIONS AND ADULT HEALTH NURSING 7TH EDITION

Foundations of Education

Fourways High School

Framework for Research Proposals

FRC

Fundamental Nursing Skills and Concepts

Fundamentals of Nursing

FUR2601

GA Level 5 Diploma in Teaching English as a Foreign Language

GA Level 5 TEFL Certificate

Garsfontein Hoërskool, Pretoria

GCE A level Pure Mathematics – Paper 1 Pure

GCE A level Pure Mathematics – Paper 2 Pure

GCSE

General History (High school or Tertiary)

General science

Generic Management NQF 5_Team Leadership

GEOGHAPHY

Geography IEB

George Washington University

Germistion Technicon

GESKIEDENIS HITLER

Getting Started on Mainframe with z - Week 3

Glenwood House College

Glenwood House School

Global School of Business

Global TEFL

Gr 12 IEB Afrikaans Additional Language

Gr 8

Grace College

Grace Trinity

Grade 10 Physical Science NSC

Grade 11 IEB

Grade 12

Grade 12 matric

Grade 2 Term 3 English HL Assessment

Grade 5 - History - Hunter Gatherers - CAPS

Grade 5 English Home Language

GRADE 6 - NATURAL SCIENCES AND TECHNOLOGY

Grade 6 English Home Language

Grade 6 Geography

Grade 6 History

Grade 6 Life Science

Grade 6 Natural Sciences and Technology

Grade 7 English Home Language

Grade 8

Grantleigh School

Greenwood Bay College

Grey College - Bloemfontein

Grey High School

GRT1501

Harvard edx Contrac Law FULL latest updated 2023

Harvest Christian School, Port Elizabeth, Eastern Cape

Hatfield Christian School, Pretoria

Hazmat

Hbedete

Helpmekaar College

Heritage School, Muldersdrift, Gauteng

Hermannsburg School

HeronBridge College

Herschel Girls School

HESI

HESI A2 READING COMPREHENSION PASSAGES 2023 FOR V1

HESI EXIT

HESI Exit V2

HESI OB MATERNITY VERSION 1 Verified Question

Hesi pediatrics peds

HESI PN

HESI PN COMPREHENSIVE EXAM3 2023 REAL EXAM LATEST

HESI PN COMPREHENSIVE EXIT EXAM 2023\\\\2024

Het Kalsbeek College, Schilderspark

HFL

HFL1501

High School

High School / Tertiary

High School grade 12

High School/University

Higher Certificate in mathematics and Statistics

Higher certificate in pre-school education

Higher Certificate in Public Management

Higher certificates in supervision management

Highschool

Highschool CAPS curriculum

Highschool CAPS Syllabus

Highschools CAPS curriculum

Highschools following CAPS curriculum

Hillcrest High School

Hilton College

HIPPA POST TEST EXAM WITH 100% VERIFIED answers

History

History Grade 7

HLT3701

HMEMS80

HMPYC80

Hoër Skool

Hoërskool

Hoërskool AFFIES

Hoërskool Fochville

Hoerskool Janviljoen

Hoerskool wagpos

Holy Rosary Catholic School for girls

Home School

Honours Psychology

Hotel Management School

HPM2602

HPM2602 EXAM

HRD2602 Assignment 03 Unique number 877613

HRM

HRM2605

HRM3703

HRM3705

HSY 2602 ASSIGNMENT 1 SEMESTER 2 2023 .

HSY2603

HUB1019S

Hudson Park High School

human nutrition

Human Resource

Hyde Park High School

Hydro international college

I PASSED THE COURSE June, 2020 AND THIS IS THE EXACT DETAILS I DID IN MY TEFL ACADEMY ASSIGNMENT. DISCLAIMER: THIS ONLY YOUR BASIS OR REFERENCE. REVISE THIS AND MAKE YOUR OWN TOPIC, DO NOT COPY AS IT IS as if you are found to have sourced any part of your

i to I

I to I TEFL

i To i TEFL - Assignment one - Vocabulary -

i to i TEFL - Level 5 Advanced Diploma

i to i TEFL - Level 5 Fundamental Basics

i to i TEFL 180 hour Completed Assignments

I to I TEFL 300 hour level 5 course assignments

i to i tefl assignment 1,2,3,4,5

I to I TEFL level 5 - 180 hour

I to I Tefl level 5- 420 hours

i-i TEFL

i-to-i

i-to-i academy-Business English Assignment- Business English-speaking-telephone language

i-to-i Assignment 1 Body Parts

I-to-i Assignment 2 - GRAMMAR

i-to-i assignment 3 - SKILLS BASED LESSON PLAN

i-to-i assignment 4 - one to one and online

i-to-i TEFL

I-to-I TEFL 180 hour

i-to-i TEFL level 5 advanced diploma

i-to-i,level 5 advanced diploms

I-to-TEFL Level 5 Diploma 300 hours

ICA150 ICA150 ASSIGNMENT 2023.

ICA1501 ASSIGNMENT 04 SEMESTER 2 UNIQUE ASSIGNMENT

ICB

ICB Corporate Strategy Summary

ICB Financial Accounting

ICB Financial Statements - FNST Summary and Notes

ICB National Diploma In Financial Accounting

ICB-BUSL

ICS3701

ICT2621 - OBJECT-ORIENTED ANALYSIS AND DESIGN

ICT2622

IEB

IEB ENGLISH

IEB Grade 12

IEB Grade 12 English

IEB Life Science Grade 12

IEB Matric

IEB NSC

IEB school

IEB/NSC

Ielts course exam prep

IELTS English Test

IFRS 5

iGCSE chemistry

IIE Varsity College

IMM Graduate School

immunology

IMPROVED NYC TOUR GUIDE EXAM

INC 3701

INC3701

INC3701 ASSIGNMENT Bibliography

Inclusive Education

IND2601

ind2601 assignment 1 suggested answers

Independent

Independent Institute of Education

INF 3707 ASSIGNMENT 3 SEMISTER 2 2023

INF1520

INF2603 question and answer OCT/NOV exam 2021

INF3703

INF3707

INF3707 Assignment 3

INF3720

INFECTION PREVENTIONIST POST TEST EXAM QUESTIONS

Information and knowledge management

Information Management

Information Technology

INS3705

INS3707

Institute for Certified Bookkeepers

Institute of Accounting Science

INSTITUTE OF CERTIFIED BOOKKEEPERS

Institute of Certified Bookkeeps

INTEGRATED LOGISTICS

Internal Auditing CIA Part 1

International School of South Afica

International School of South Africa

Internet_as_a_push_and_pull_advertising_medium

INTRODUCTION TO AFRICAN PHILOSOPHY

Introduction to Criminology:Victims and Reduction of Crime

Introduction to Critical Care Nursing

Introduction to psychology PYC1511

Introductory Financial Mathematics - DSC1630

IOP1501

IOP1601-23-S2Assessment 1.pdf

IOP2601

IOP2601 Organisational Research Methodology

IOP3703

IRM1501

ISC3701

Ista Ntic

ISYE 6501

IT COURSERA;Basic System Programming on IBM Z

IT COURSERA;Introduction to Enterprise Computing

IT COURSERA;System Administration and IT Infrastr

ITN 100 FINAL EXAMWITH COMPLETE UPDATED

itoi

Itoi tefl

Itori

Jan van Riebeeck

Jawaharlal Nehru Technological University, Kakinada

JEE

Jeppe High School for Boys

johannesburg polytech institute

Jolly Phonics certificate

June Exam

Kearsney College

Khanyisa Education Centre

KING DAVID

King David High school

King David High School Linksfield

King David Highschool Linksfield

King David Linksfield

King David Linksfield High

king david victory park

King David Victory Park High School

King Edward VII School

Kingsmead College

Kingsway High School

Kingswood College

KISWAHILI

Kloof High School

Kuswag Skool, Amanzimtoti, KwaZulu Natal

La Salle College

Labour Law

LADTECX

LAH3701

Lahore Crammer School

Languages

LATEST UPDATED 2024 RN ATI FUNDAMENTAL PROCTORED

Law

LAW OF DAMAGES

Law Admission exams

LAW OF DAMAGES ASSIGNMENT 1

LAW OF DAMAGES PORTFOLIO

Law of Sucession

Law Professional Examinations

LAW RRLLB81

LCP4801 summary notes T201

Leadership and Self-development

learners licence

Learners license

Learning Strategies International College , Northcliff, Johannesburg, Gauteng

Legal Philosophy LJU4801

Lehne\\\'s Pharmacology for Nursing Care

LEV 3701

LEV3701 Assignment 01 semester 2

LEV3701 Assignment 1 2021

Level 5 TEFL Academy Assignment B

Level 5 300 hour online TEFL i to i diploma

Level 5 TEFL Academy Assignment C

Level 5 TEFL Course

Level 5 TEFL Course (Qualifi)

lewenswetenskappe

LGL3702

life

Life Sciences

Lifescience

LJU4801

LJU4801 Portfolio 29 May 2023FOOTNESS

LJU4804

LLB

LLB 3RD

LLB 4th year

LLB2ND YEAR

LLW2602 Assignment 1

LME3701 ASSIGNMENT 02 SEMESTER 01 2022

LML4805

LML4806

LML4807

Lower primary education

LPL SEMESTER 2 ASSIGN 1

LPL4802

LPL4802 ASSIGNMENT 01

LPL4802 Assignment 01 Answers

LPL4802 Assignment 01 exam question and answers

LPL4802 ASSIGNMENT 01 SEMESTER 2

LPL4802-ASSIGN 1 GUARANTED PASS 2023

LPL4802-ASSIGN 1 S2 2023 STUDYNOTES GUARANTEED PAS

LPL4802-ASSIGN GUARANTEED PASS DUE DATE 6 NOVEMBER

LPL4802-DAMAGES OUTLINE GUARANTEED PASS DUE DATE 6

LSK 2601 ASSIGNMENT 2. DUE AUGUST 8 2023.

LSK2601

LSK2601 Assignment 2 Semester 2 (Due 8 August 202

LSK2601 Assignment 2 Semester 2. LSK2601

LSP1501

mAC

mac2601

MAC2602

Mac2602 assignment 1&2

MAC3701

mac4865

Maharishi University Of Management

MAM1022F

Management Accounting

Management College of Southern Africa

Managing Human Resources

MANCOSA

MANCOSA -MANAGEMENT COLLEGE OF SOUTH AFRICA

Mangosuthu University Of Technology

Maragon Private Schools

Maris Stella

Maris Stella school

Marisstella

Marketing Management

Mass communication

MAT 1503 ASSESSMENT 4

MAT1503

Maternal Child Nursing Care, 6th Edition

MATH DSC 1650

Mathematics

matric

Matric IEB

Matric Learning

Matric student 2020

Matriculates

Mayfair Convent School

Mbn1501

MCSA

mechanical Engineering

MEDICA ASSISTANT

Medical

medical diagnosis and treatment

Medical institute

Medical-Surgical Nursing

medicine

Megamind Tutor Centre

Merensky Hoerskool

Mfingose Matric Improvement Plan

MFP1501

MFP2601

MGT230

Michaelhouse, Balgowan, KZN

Micro Economics

MICROBIOLOGY FUNDAMENTALS:

Microsoft Azure Certifications

Microsoft Azure Fundamentals

MID-TERM PHARMACOLOGY QUESTIONS

midlands state university

Midstream College High School

Midstream College Secondary School, Midrand

Midterm Exam Review - NR511 / NR 511 (Latest 2022

Milpark Business School

Mindfulness

Ministry

MNB 1501

MNB1501

MNB1501 Assessment 2 Answers 2024

MNB1601 Assessment 4 2023

MNB1601 Assignment 4 Semester 1 2022

MNB3701

MNB3701 Assignment 2 Report Semester 1

MNB3701/PORTFOLIO OF WORK/SEMESTER 1/2023.

MNE 2601 Assignment 06_S2

MNE3702

MNG 2602

MNG1502

Mng2601

MNG2601 Assignment 2 Semester 2 2022

MNG2601 ASSIGNMENT 3 SEMESTER 2 2022

Mng2601 Assignment 6 semester 2 2023

MNG2601-Assignment 5

MNG2602

MNG301A STUDY GUIDE UPDATED2023.STRATEGIC PLANNIng

Mng3701

MNG3701: STRATEGIC PLANNING

MNG3702

MNG3702 ASSIGNMENT 1 SEMESTER 2 - 2023 MNG3702

MNG3702 ASSIGNMENT 2 OF SEMESTER 1 2023.

MNG3702 STRATEGY IMPLEMENTATION AND CONTROL 70

MNG4804

mnm

MNM1506

MNM2604

MNM2607

MNM2611

MNM2615

MNM3701

MNM3702

MNM3710

MNM3711

MNM3714

mno15

Modern Perspectives of Purchasing MGT (MANCOSA)

Montessori

Montessori Academy

Montessori Teaching Diploma Course

MRL2601

MRL2601 Assignment 1 2023

MRL2601 Entrepreneurial law 201 memo

MRL3701 Insolvency law lecture notes memo

Mrl3702 assignment 1 semester 1

MSN 571 PHARMACOLOGY FINAL EXAM

N.N.N Ndebele high school

N/A

NA

NabzGuides

NASM/AFAA

NASM/AFAA Group Fitness Instructor 2023-2024 Exam

National Benchmark Test

National Prosecuting Authority Entry Exam

National School of the Arts

National Senior certificate: Mathematics

NBDE

NBME CBSE

NBME CBSE ACTUAL EXAM 200 QUESTIONS AND ANSWERS LA

NBRC TMC/CRT/RRT EXAM LATEST 2023- 2024

NCFE CACHE Level 3 Diploma

NCLEX FILE 2

NCLEX HESI

NCLEX RN ACTUAL

NCLEX-RN CRITICALCARE TESTBANK 2023

NCLEX-RN V12.35

NEBOSH

Nelson Mandela Metropolitan University

Nelson Mandela University

Network Services

NEW AZ 104 RENEWAL

NEW GENERATION ATI COMPREHENSIVE EXIT EXAM 2023

NEW GENERATION ATI COMPREHENSIVE EXIT EXAM RETAKE

New York University

NEW!!! {NGN} ATI RN VATI Comprehensive Predictor 2

NEW!!! Relias ED RN A Test2023-2024

NEW!!! Relias RN Pharmacology Test A Relias2023 A

NEW!!! Ryanair Initial Exam Questions and Answers

NGN ATI MENTAL

NGN ATI MENTAL HEALTH

NGN EXIT HESI Comprehensive B Evolve Practice Que

NGN RN HESI EXIT EXAM 2023 QUESTIONS & ANSWERS INC

NHA: Medical Assistant

NJ Boating Test

NMTCB PET certification Review2023-2024 questions

North Central Michigan College

North west university

North-West University

northrise university

Notarial Practice South Africa

NQF level 4

NR 449 EVIDENCE BASED PRACTICE Questions and answe

NR 503 Chamberlain Midterm Exam2023 -2024 Question

NR 503 Week 8 Final Quiz Population Health Epidemi

NR 507 Week 4 Midterm Advanced Pathophysiology Mi

NR 509 APEA NEUROLOGY

NR 509 Final Exam Questions and Correct Answers 20

NR 565 ADVANCED PHARMACOLOGY CARE OF FUNDAMENTALS

NR 565/NR565 ADVANCED PHARMACOLOGY EXAM REVIEW

NR 599 WEEK 4 MIDTERM EXAM TEST BANK LATEST

NR222 / NR 222 : Health & Wellness

NR509 / NR 509 Actual Midterm Exam /GRADED A REAL

NR511

NR565/NR 565 ADVANCED PHARMACOLOGY FUNDAMENTALS

NR602 Final Exam LATEST 2022-2024 NR 602 FINAL EX

NRNP 6568 Week 7 Comprehensive Practice

NRNP 6640 final exam2023-2024 Q & A ALL ANSWERS 10

NRNP 6665-01 WEEK 11 FINAL EXAM

NRNP 6675-15 Week 6 Midterm Exam -with verified 10

NSC/CAPS Schools

Nsg 233 med surg 3 exam 4 questions and answers (2

NSG 533 advanced pharm TEST 1 WEEK 4 2022-2024 wit

NSO1505 Assignme

Nst2602

NUR 1055 INTRODUCTION TO NURSING

NUR 2063 Pathophysiology Final Exam LATEST UPDATE

NUR 305 adult health 1

NUR 513.

NUR 631 FINAL, PRACTICE EXAM AND STUDY GUIDE

NUR 631 MIDTERM EXAM WITH 100% CORRECT ANSWERS

NURS 211 - LifeSpan1 - Midterm. Questions and Answ

NURS 629 EXAM 3 2023-2024QUESTIONS AND ANSWERS LA

NURS 6521 / NURS6521 Advanced Pharmacology Midterm

Nursing

NURSING MISC APEA TEST BANK WITH RATIONALE

nutrition

NWEG

nwu

Oakhill School

Oakhill School Knysna

OB HESI EXAMS 1 version 1,2,3 LATEST UPDATE DETAIL

OLENG 171

Online

Online Level 5 Course TEFL Assignment A

Online School

OPM1501

Organisational and Industrial Psychology

Orient

OTE2601

OTE2601 ASSIGNMEMT 2 0RIENTATION TO TEACHING

OTE2601 ASSIGNMENT 2 627109990

OTE2601 Assignment 2 Semester 2 2023 answers

Other

OUniversity of South Africa

Our lady of fatima

Our lady of Fatima University

Our Lady of Grace International School

Overkruin Hoërskool

OVM3701

Oxbridge Academy

PA Pesticide Applicator Exam Core Info with correc

Paarl Girls High School

Paarl Girls\' High School

Parel Vallei High School

Parklands College

Parktown Boys\' High School

Payroll and Monthly SARS-ICB

PCGE in education

PDU3701

Pearson Assignment 1\\\\

Pearson High School, Port Elizabeth, Eastern Cape

Pearson Institute of Higher Education

Pecanwood College

PED

Penryn College

Personal

Personal Book

Personal Tutor

Personal Writing

Perspectives on Accountancy

PGCE

PGCE and Bachelor of education

PGCE and BED

Pharmacology: A Patient-Centered Nursing Process A

Pharmacotherapeutics for Advanced Practice Nurse

Philosophies and Theories for Advanced Nursing Pra

PHTLS 8TH TEST WITH

PHY1506

physics

physiotherapy

Pietersburg Hoërskool, Polokwane

PLC

PLC2602

PLC2602 ASSIGNMENT 1 2023

pls

PLS1502

PLS1502 exam

PLT - Wills and Estates

PLT PVT LSSA

PLTW

plv2602

PMHNP, Walden University

PN COMPREHENSIVE PREDICTOR 2020 with NGN QUESTION

PN Comprehensive Predictor 2022-2023 latest

PN Comprehensive Predictor 2022-2023latest exam15

PN COMPREHENSIVE PREDICTOR 2023 with NGN

Poetry

POL2601 EXAM 2023 SUP

POL2602 Assignment 1 for 2023 Semester 2.pdf

Police academy

Political Science

Portage Learning BIOD 171 Microbiology Lecture Exa

PORTAGE LEARNING NURS 231 Final Exam

Portage Learning NURS 231 Pathophysiology 2022/ 20

PORTAGE MICROBIOLOGY FINAL EXAM Microbiology

Postgraduate Certificate in Education

POSTMODERN PHILOSOPHY OF RELIGION, RST3708

Potchefstroom Gimnasium

Potchefstroom High School for Girls

Practical training for law practitioners

pre school Math Worksheets

PREPARE & FINISH RECONSTITUTED FOODS

Preschool complete workbook

presentation

Prestige College

Pretoria Boys High School

Pretoria High School for Girls, Gauteng

PRF3702

Primary School

Prince Mohammad Bin Fahd University

Principles Of Real Estate

Private

Private tutoring

Prm3701 assignment 6 solution.semester 2 2023

ProBeta Budgeting and Forecasting

ProBeta Business Valuation

Professional Nursing Concepts

Programme in Business Management

Programme in grade R teaching

PROJECT MANAGEMENT MILESTONE 2 ALL CORRECT ANSWERS

prophecy

PSC1501

PSE4801 ASSIGNMENT

PSE4801 exam

PSI life, accident, and health Exam 2023-2024Quest

PST312

PST312M

PSW

Psychology

Psychopathology

Pub2606

Pub3701

Public Administration

Public relations

Public School

Pune University

PUniversity of South Africa

purchasing management

purdue global university

PVL 2601

PVL 3704

PVL1501 - UNIT 4

PVL1501 ASSIGNMENT 01

PVL1501 Summary of the prescribed book

PVL2601

PVL2602

PVL2602 Law of succession

PVL3701

PVL3701 LAW OF PROPERTY

PVL37012

PVL3702 Assignment 1 Suggested Answers

PVL3702 Q&A for assignment 1 201

PVL3704

PYC 1501

PYC 3701

PYC1501 Basic Psychology

PYC1511

PYC2601 - Personality Theories

pyc3703

Pyc3704

PYC3704 Tutorial letter

PYC3705 Transformative Counselling

PYC3705 Transformative Counselling Encounters

Pyc4804

PYC4808

Pyc4810

PYC4812

QASP-S Study Guide 2023 170+questions with correct

Qmi1500

Qualitas Career Academy

Rand Park High School

Rasmussen College

RCE2601

RDF 2601

RECA RESIDENTIAL EXAM 2023-2024 ACTUAL EXAM 200+

RECENT ATI CAPSTONE NEWBORN ASSESSMENT

Reddam House

Reddam House College

Reddam House Waterfall Estate

Reddford House Northcliff

Redhill School

Regent Business School

Registered Nurse Educator

RELIAS DYSRHYTHMIA BASIC A & B 35 QUESTIONS WITH A

RELIAS DYSRHYTHMIA BASIC TEST

Relias ED RN A, Complete Test Fall 2023 What is th

RELIAS RN PHARMACOLOGY TEST A ACTUAL EXAM LATEST

Religious studies

Research

Research Theory and Practice

Research theory and practice - ICB

Rhenish Girls\' High School, Stellenbosch

Rhodes University

Richards Bay Christian School

RICHFIELD GRADUATE INSTITUTE OF TCHNOLOGY

Richfield graduate of institute of technology

RIVER EROSION GIZMOS

RN Pharmacology A Relias A| 2023/2024 | Exam Quest

Rodean

Roedean School

Rosebank College

RRLLB81

RSC 2601

rsc2601-exam-preparation-questions-and-answers

RSE4801_Assignment_1_2023

rsk

RSK2601

RTTGF

Rustenburg High School for Girls, Cape Town

Rustenburg Hoërskool

RYANAIR CONVERSION 2 EXAM 2023 LATEST QUESTIONS A

Ryanair Conversion 2023-2024 Exam Questions With

SACAP

sacred heart university

SAE 3701

SAE Institute South Africa

SAE3701

SAE3701 Assignment 3 2023 - DUE 17 July

Sagewood School, Noordwyk, Midrand

Saheti School

Sanford

SAQA - 7468

SAQA - 7470

SAQA - 7484

SAQA - 7570

SAQA - 9015

SAQA - 9016

SAQA - Produce and Use Spreadsheet for Business

Sarel Ciliers High School

sastri college

SC College

School

SCL1502 Legal research 201 memo

SED2601

Self Help

SEP3707 ASSIGNMENT 2 SEMESTER 2 2023

SEP3707 ASSIGNMENT 2 SEMESTER 2 2023

Series 65 License

ServSafe Food Manager

Shelis Training Centre

Shelis Tutorial Centre

Silvermine Academy

Sithokozile High School, Durban

Sixth year / 12th Grade

SM+TB

smart money concept full course

SMU Med.

Soc2604:SOCIOLOGY OF FAMAILIES AND SOCIAL PROBLEM

SOC3702

Social Science

social_innovation_trigger_for_transformations

Sol Plaatje University

Somerset College, Western Cape

SonicWALL Basic Administration Questions

SONICWALL SNSA EXAM LATEST 2023 REAL EXAM V2 100 Q

Sosiale Wetenskap Gr 8

South African College of Applied Psychology

South African College Schools

Southdowns College, Centurion, Gauteng

Southern Business School

Southern Cross College

Spelling book gr4-6.

Springfield

Springfield Convent Senior School

SSO1507 ,2024, MLC

St Alban\'s College

St Alban\\\'s College

St Andrew\'s College, Grahamstown

St Andrew\'s, Bedfordview

St Andrew\\\'s College, Grahamstown

St Andrew\\\'s, Bedfordview

St Anne\\\'s College

St Annes Diocesan College, Hilton, Kwa-Zulu Natal

St Benedict\'s College

St Benedict\\\'s College

St Conrad\\\'s College

St Cyprian\'s School

St Cyprian\\\'s High School

St Cyprian\\\'s School

St Cyprian\\\\\\\'s School

St Cyprians

St Cyprians School

St David\'s Marist College

St Dominic\'s

St Dominic\'s Academy

St Dominic\'s Catholic School for girls

St Dominic\'s Priory School, Port Elizabeth

St Dominic\\\'s Academy

St Dominic\\\\\\\'s Academy

St Dominics Boksburg

St Dunstan\'s College

St John’s College, Johannesburg

St John\'s College, Johannesburg

St John\\\'s College, Johannesburg

St John\\\'s DSG

St John\\\\\\\\\\\\\\\'s DSG

St Martin\\\'s, Rosettenville

St Mary\'s Diocesan School for Girls, Kloof

St Mary\'s Diocesan School for Girls, Pretoria

St Mary\'s School, Waverley, Johannesburg

St Mary\\\'s Diocesan School for Girls, Kloof

St Mary\\\'s DSG

St Mary\\\'s School, Waverley, Johannesburg

St Nicholas Diocesan School , Pietermaritzburg

St Peter\'s College

St Peter\\\'s College

St Peter\\\\\\\\\\\\\\\'s College

St Stithians College

St Teresa\'s Mercy School, Rosebank, Johannesburg

St Teresa\\\'s Mercy School, Rosebank, Johannesburg

St. Dominics Catholic School for Girls

STA1501

STA1610

STADIO

stamford university Bangladesh

Stanford Lake College

Stanford University

Stanhope Ch. 1 Foundation of Public Health Nursin

Statistical Modelling

Statutory Interpretation

Stellenberg Hoërskool

Stellenbosch Hoërskool, W Cape

Stellenbosch University

Stirling High School, East London, Eastern Cape

STRAIGHTERLINE NUTRITION 101 FINAL EXAM VERIFIED

Strategic Implementation and Control IIIB

Strategic management

Study Tips

Summary Cambridge International A Level Psychology

Summit College, Kyalami, Gauteng

Surgery

SUS

SUS1501

SUS1501 ASSIGEMENT 5

SUS1501 ASSIGMENT 2

SUS1501 ASSIGMENT 3

SUS1501 ASSIGMENT 7

SUS1501 ASSINGMENT 4.

Sustainability and greed

Sustainable Living 771

TAM2601

TAX

TAX 2601

TAX2601

TAX2601 - Principles Of Taxation

TAX2601 Assignment 5

tax3702 assignment6 semester 2 2022

TAX4863-Advanced Case Law prev Q & A 2018-22

TCIC/TLETS FULL ACCESS RECERTIFICATION EXAM

Teach Me 2

Teacher interview

Teaching

TEACHING BEDS421

TEACHING ENGLISH FIRST ADDIONAL LANGUAGE

TEACHING FET MATHEMATICS

Teaching home languages in FET

Teachme2

Teachme2-tutor

TEAS 6

Tech Talks

TEFL

TEFL 120,140,180 Hours

TEFL 180H First Assignment, Vocabulary

tefl 240 hours

tefl 420 course

tefl 5

TEFL 500 Hours

tefl acadamy

TEFL Academy

TEFL Academy 168 Hour

Tefl Academy Assignment B

TEFL Academy Level 5

TEFL Academy TQUK Level 5 Certification

TEFL Assignment 1 300 h

TEFL Certification

tefl english

Tefl Fullcircle

TEFL GRAMMAR ASSIGNMENT SHOULD/SHOULDN\\\'T 2

TEFL i-to-i Level 5

TEFL LESSON

TEFL lesson Plan Ass 1

TEFL level 5

TEFL Level 5 - Assignment 1 - Vocabulary Noun

TEFL Level 5 360 Hour Diploma

TEFL Level 5 Certificate

TEFL Level 5 Certification

TEFL Level 5 Diploma 420 hours

TEFL Level 5 Diploma 420 hours Fundamental Basics

Tefl level 5 I-to-i

TEFL ON THE BEACH

Tefl on the beach Assignment 1

TEFL One to One online Assignment

Tefl online 168 hours

tefl online assignment 1 lesson plan

TEFL Teacher Training

TEFL Teaching English online

TEFL TQUK Level 5 168 Hours Certification

TEFL TQUK Level 5 Certification

TEFL unit 5 Lesson Plan 1

TEFL UNIVERSAL

TEFL Universal 120 hour course

TEFL Universal 120hr

TEFL Universal 120hr Course

Tefl.org

Tefl.org.uk

TEFL5

Teflonthebeach Q&A 1-6

Tegnology Grade 7 Term 4

Temple University

Teneo

Tesr

TEST BANK COMPLETE Advanced Practice Nursing, 6th

Test Bank for Biology of Humans Concepts Applicati

Test Bank for Brunner & Suddarth\\\'s Textbook of Med

Test_Bank_for_Strategic_Compensation_A_Human_Resou

Texas Principles Of Real Estate

The British Academy

The Business School of South Africa

The Ellen Wilkinson School for Girls

The Glen High School

The Hill College

The International Hotel School

The King\'s College

The Kings School, Robinhills, Gauteng

The Kings School, West Rand

The Open Window Institute

The TEFL Academy

The TEFL Academy

THE TEFL ACADEMY - LEVEL 5

The TEFL Academy Level 5 TEFL Course

The TEFL Acedemy

The University of Pretoria

The University of the Witwatersrand

The Wykeham Collegiate

Theodor Herzl

Therapeutic Interventions 8112 2023 Exam

THF1501

Thomas More College

TIC3702 - Describe and discuss critically Prof E van Niekerk’s views on the Theanthropocosmic and an

TIMBY\\\'S FUNDAMENTAL NURSINGSKILLS AND CONCEPTS 12T

Time management: month to do list calendar

TLI 4801

TLI4801

TMN 3705

TMN3701 Assignment 3 2023 - 21 July 2023

TMN3702

TMN3704

TMN3704 Assignment 3 UPDATED VERSION 2023.

TMN3704 ASSIGNMENT.

tmn3705

TMN3705 Assignment 2

TMN3706 Assignment 3 with Complete Solution 2023

tms

tms37

TMS3704

tms3708

TMS3713

TMS3719 Assignment 11 Semester 2Due 11 August 2023

TMS3721

TMS3723

Total Quality Management. MNO3703

Tourism

Tourism Management

TPF2601

TPF2602

Tpf2602Assignment50

Tpf2602Assignment51

Tpf3703Assignment 50

Tpf3703Assignment51

TPN2601 portfolio

TPN3704 Portfolio

Traffic Services

Trinity house High school

Trinity house Randpark Ridge

Trinity Musical Theory

TrinityHouse

Trinityhouse High School Randpark Ridge

TRL3703 ASSIGNMENT 5

TRL3705

TRL3705 Assignment 2

TRL3707

TRL3709

Tshwane south college

Tshwane University of Technology

Tuks

TuksSport Highschool

Turkish Language simple words and phrases

Turkish Vocabulary

Tutor

TVET

TWF1501

Tyger Valley College

Tyger Valley College, Pretoria East, Gauteng

U.

U11A4 Official 2021 - Unit 11 for biology unit BTE

UCT

UKZN

UN QMI1500

undefined

UNDERSTANDING PATHOPHSIOLOGY 6TH EDITION TEST BANK

Unicaf

Unisa

Unisa legal philosophy Assignment 3 2020

UNISA,UJ,UP,STELLENBOSCH

univen

Universidade federal de Goiás

UNIVERSIDADE FEDERAL DO CEARÁ

Universidade Ritter dos Reis

Université de Bucarest

University

University of Alabama at Birmingham

University of Cape Town

University of Central Florida

University of Fort Hare

University of Forthare

University of Forthere

University of Free State

University of Johannesburg

University of KwaZulu-Natal

University of Limpopo

University of London

University Of Machias

University of Mpumalanga

University of Nairobi

University of Namibia

University of Phoenix

University of pre

University of Pretoria

University of Puerto Rico at Mayaguez

University of South Africa

University of South Africa ; Tshwane University of Technology

University of South Africa (Unisa)

University of South Africa Unis

University of South African

University Of South Florida

University of the Freestate

University of the Western Cape

University of the Witwatersrand

University of Venda

University of Witswaterand

University of Witswatersrand

University of Witwatersrand

University of Zululand

Unknown

Uop

UP

Uplands College

Urdu language through English

USMLE

USPAP 15-HOUR

USPS 421

Vaal University of Technology

Varisty college

Varsity College

Vega

Vega School of Brand Leadership

verbruikerstudies

Veritas College, Springs, Gauteng

Vhembe fet

Victimology

Victory Training College, Johannesburg, Gauteng

Virginia Volkskool, Virginia, Free State

Vista Nova Highschool

Walter Sisulu University

Westerford High School, Rondebosch, Western Cape

Westville Girls\' High School

Westville Girls\\\' High School

Westville Girls\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\' High School

WFI Ingolstadt

WGU D152

WGU D491 INTRODUTION TO ANALYTICS AND PRACTICE

William Paterson University

Witteberg Hoërskool

Witwaterstrand University

Woodhill College

Woodlands College

Woodridge College & Prep School

Yeshiva College of South Africa

Zewail University Of Science And Technology

ZOL

Your school or university

Improve your search results. Select your educational institution and subject so that we can show you the most relevant documents and help you in the best way possible.

Ok, I understand!

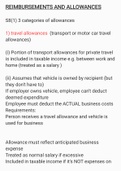

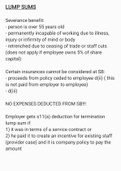

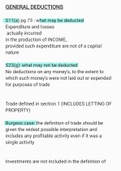

Taxation

Academic Writing

Accounting

Accounts

Advanced calculus

Africa in Globalising

Afrikaans Notes

Anat201 - introduction to anatomy

Anat202 - neuroanatomy

Anatomy

Anatomy 115

anatomy115

applied mathematics

Applied Mathematics 1B

ASD test answers

Auditing

B sc Eng electrical

Bachelor Of Commerce In Accounting

Bachelor Of Education

Bachelor of education physical sciences

Bachelor Of Laws

Bachelor Of Medicine And Surgery

Bachelor of sciences in Electrical engineering

Bioc201

Bioc703

Bioc705

Biotechnology

BMedSci of Anatomy

BSc Electrical Engineering

Chemistry

Clinical Law

Clinical phonetics and linguistics

Clinical Science

CMED1BF

Commercial Law

communication in science

Community Development Theories

corporate law

Counselling & Psychotherapy Egan & Corey Year 3 UKZN

Criminalistics

Data structure and algorithms

Developmental Psychology

DIGITAL ELECTRONICS

E-M THEORY

ECON202

EDEN113

education

Education Studies

Educational studies

Electrical Engineering

ENG101

ENGL 303 !

ENGL301P1 English 3: Canonical/Period Studies

English

ENME1ED

Environmental Science

ETHICS204

FIN3701

FINANCIAL ACCOUNTING

HIST201

Human communication disorders

Human Resources

Human Rights

Information Systems and Technology

Interpretation of law

Intro to Head and neck anatomy

Introduction in Psychology

introduction in research

Introduction to Calculus

Introduction to Commercial Law

Introduction to Economic Concepts 111

Introduction To Engineering Materials

Introduction to Isizulu B

Introduction to Macroeconomics

Introduction to medical anthropology

Introduction to Mycology and Virology_215

Introduction to Psychology

Introduction to psychology: Autism Spectrum

Introduction To Research

Introduction to Statistics

Java

Life Science

Macroeconomics

Managerial Accounting

Marketing

Math 132

Math 150

math 246

MATH142

MATH354

Mathematics

Matter - its properties and measurement

MBCHB

Medical Sciences

MEDICINE

Microeconomics

Music History

Music Theory

occupational therapy

ORGANIC CHEMISTRY SUMMARY UKZN 110

Pharmacy

PHYS132

Physiology

POLS101

POLS102

Pols206 -Contemporary African Politics development

PSYC209- African & International perspectives of psychology

PSYC301- measurements, experiments and observations.

PSYC326H1

Psychology 304 -Health and Illness

Psychology 701

Research Techniques in Housing

selected topics in electrical engineering

Social Psychology

Social Science

Sociology

Soil and water conservation

STAT130

Statistics

STATS130

Taxation

TEFL Academy

TEFL Academy - assignment 1

Theories of Personality

Zulu - An introduction