AIM Slides

College 1

MNE: direct investment in foreign countries, actively manages foreign assets.

Theory of internationalization: Uppsala model

Firm specific advantages

Network centrality

Brokerage

Global strategy: basis means by which the company competes (choice of business and how it

is differentiated from that of its competitors). Needed in global industries in which the

competitive position of a firm at home is affected by its competitive position in a foreign

market.

Home region oriented: over 50% sales in home region

Host region oriented: over 50% sales in host region

Bi-regional: over 20% in each of two regions, less than 50% in one region

Global: over 20% in all markets, less than 50% in one market

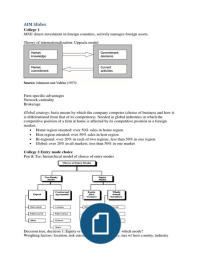

College 2 Entry mode choice

Pan & Tse: hierarchical model of choice of entry modes

Decision tree, decision 1: Equity or non-equity? Decision 2: which mode?

Weighing factors: location, risk orientation, power distance, ties w/ host country, industry

, Contractual agreements (alliance) vs. equity joint ventures

Equity joint venture vs. wholly owned subsidiary = Hennart & Reddy

Greenfield vs. acquisition = Harzing

Firm Assets & Entry Mode Choice

Joint venture vs. Acquisition

-Asset indigestibility -Asset digestible

(Tied/nondesired assets) (Small firm or divisionalized)

-Unclear value of assets -Clear value of assets

(Firm is in different industry) (Firm is in same industry)

Isomorphism: imitation behavior, internal (US firm sticks to US salaries) or external (US firm

pays salary according to host country standards)

Strategy & entry mode choice

Greenfield vs. Acquisition

Global strategy Multidomestic strategy

-Globalization -Local adaption

-Exploitation of -Exploitation of location bound FSA

non-location bound FSA -External isomorphism

-Internal isomorphism

College 3

Clusters: competition & cooperation = co-opetition

Differentiation: brand equity, higher prices, desirable features

Externality

College 1

MNE: direct investment in foreign countries, actively manages foreign assets.

Theory of internationalization: Uppsala model

Firm specific advantages

Network centrality

Brokerage

Global strategy: basis means by which the company competes (choice of business and how it

is differentiated from that of its competitors). Needed in global industries in which the

competitive position of a firm at home is affected by its competitive position in a foreign

market.

Home region oriented: over 50% sales in home region

Host region oriented: over 50% sales in host region

Bi-regional: over 20% in each of two regions, less than 50% in one region

Global: over 20% in all markets, less than 50% in one market

College 2 Entry mode choice

Pan & Tse: hierarchical model of choice of entry modes

Decision tree, decision 1: Equity or non-equity? Decision 2: which mode?

Weighing factors: location, risk orientation, power distance, ties w/ host country, industry

, Contractual agreements (alliance) vs. equity joint ventures

Equity joint venture vs. wholly owned subsidiary = Hennart & Reddy

Greenfield vs. acquisition = Harzing

Firm Assets & Entry Mode Choice

Joint venture vs. Acquisition

-Asset indigestibility -Asset digestible

(Tied/nondesired assets) (Small firm or divisionalized)

-Unclear value of assets -Clear value of assets

(Firm is in different industry) (Firm is in same industry)

Isomorphism: imitation behavior, internal (US firm sticks to US salaries) or external (US firm

pays salary according to host country standards)

Strategy & entry mode choice

Greenfield vs. Acquisition

Global strategy Multidomestic strategy

-Globalization -Local adaption

-Exploitation of -Exploitation of location bound FSA

non-location bound FSA -External isomorphism

-Internal isomorphism

College 3

Clusters: competition & cooperation = co-opetition

Differentiation: brand equity, higher prices, desirable features

Externality