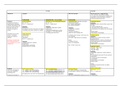

Correct Answers!!

Return on Assets CORRECT ANSWERS net income/average total assets

Profit Margin CORRECT ANSWERS net income/sales revenue

Asset Turnover CORRECT ANSWERS sales revenue/average total assets

Dupont Analysis CORRECT ANSWERS ROA = Profit Margin * Assets Turnover

Return on Equity CORRECT ANSWERS net income/average shareholders' equity

ROE Analysis CORRECT ANSWERS ROE = Profit Margin * Assets Turnover * Equity

Multiplier

Equity Multiplier CORRECT ANSWERS (liabilities + owners' equity)/owners' equity

Working Capital CORRECT ANSWERS current assets - current liabilities

Current Ratio CORRECT ANSWERS current assets/current liabilities

Quick Ratio CORRECT ANSWERS (cash + marketable securities + receivables) /

current liabilities

Debt-To-Equity CORRECT ANSWERS total liabilities/total equity

Receivables Turnover CORRECT ANSWERS sales revenue/average a/r

Average Collection Period CORRECT ANSWERS 365/a/r turnover

Inventory Turnover CORRECT ANSWERS cogs/average inventory

Average Days Inventory Held CORRECT ANSWERS 365/inventory turnover

Payables Turnover CORRECT ANSWERS cogs/average a/p

Average Days Payables CORRECT ANSWERS 365/a/p turnover

Days in Financing CORRECT ANSWERS days in inventory + days in a/r - days in

payables

Methods to Improve Cash Conversion Cycle CORRECT ANSWERS reduce days in

inventory; reduce days in a/r; increase days in a/p