CHAPTER 8

FLEXIBLE BUDGETS, OVERHEAD COST VARIANCES, AND

MANAGEMENT CONTROL

8-1 Effective planning of variable overhead costs involves:

1. Planning to undertake only those variable overhead activities that add value for

customers using the product or service, and

2. Planning to use the drivers of costs in those activities in the most efficient way.

8-2 At the start of an accounting period, a larger percentage of fixed overhead costs are

locked-in than is the case with variable overhead costs. When planning fixed overhead costs, a

company must choose the appropriate level of capacity or investment that will benefit the

company over a long time. This is a strategic decision.

8-3 The key differences are how direct costs are traced to a cost object and how indirect costs

are allocated to a cost object:

Actual Costing Standard Costing

Direct costs Actual prices Standard prices

× Actual inputs used × Standard inputs allowed for actual output

Indirect costs Actual indirect rate Standard indirect cost-allocation rate

× Actual inputs used × Standard quantity of cost-allocation base

allowed for actual output

8-4 Steps in developing a budgeted variable-overhead cost rate are:

1. Choose the period to be used for the budget,

2. Select the cost-allocation bases to use in allocating variable overhead costs to the

output produced,

3. Identify the variable overhead costs associated with each cost-allocation base, and

4. Compute the rate per unit of each cost-allocation base used to allocate variable

overhead costs to output produced.

8-5 Two factors affecting the spending variance for variable manufacturing overhead are:

a. Price changes of individual inputs (such as energy and indirect materials) included in

variable overhead relative to budgeted prices.

b. Percentage change in the actual quantity used of individual items included in variable

overhead cost pool, relative to the percentage change in the quantity of the cost driver

of the variable overhead cost pool.

8-6 Possible reasons for a favorable variable-overhead efficiency variance are:

• Workers more skillful in using machines than budgeted,

• Production scheduler was able to schedule jobs better than budgeted, resulting in

lower-than-budgeted machine-hours,

• Machines operated with fewer slowdowns than budgeted, and

• Machine time standards were overly lenient.

8-1

, 8-7 A direct materials efficiency variance indicates whether more or less direct materials

were used than was budgeted for the actual output achieved. A variable manufacturing overhead

efficiency variance indicates whether more or less of the chosen allocation base was used than

was budgeted for the actual output achieved.

8-8 Steps in developing a budgeted fixed-overhead rate are

1. Choose the period to use for the budget,

2. Select the cost-allocation base to use in allocating fixed overhead costs to output

produced,

3. Identify the fixed-overhead costs associated with each cost-allocation base, and

4. Compute the rate per unit of each cost-allocation base used to allocate fixed overhead

costs to output produced.

8-9 The relationship for fixed-manufacturing overhead variances is:

Flexible-budget variance

Efficiency variance

Spending variance (never a variance)

There is never an efficiency variance for fixed overhead because managers cannot be

more or less efficient in dealing with an amount that is fixed regardless of the output level. The

result is that the flexible-budget variance amount is the same as the spending variance for fixed-

manufacturing overhead.

8-10 For planning and control purposes, fixed overhead costs are a lump sum amount that is

not controlled on a per-unit basis. In contrast, for inventory costing purposes, fixed overhead

costs are allocated to products on a per-unit basis.

8-11 An important caveat is what change in selling price might have been necessary to attain

the level of sales assumed in the denominator of the fixed manufacturing overhead rate. For

example, the entry of a new low-price competitor may have reduced demand below the

denominator level if the budgeted selling price was maintained. An unfavorable production-

volume variance may be small relative to the selling-price variance had prices been dropped to

attain the denominator level of unit sales.

8-2

FLEXIBLE BUDGETS, OVERHEAD COST VARIANCES, AND

MANAGEMENT CONTROL

8-1 Effective planning of variable overhead costs involves:

1. Planning to undertake only those variable overhead activities that add value for

customers using the product or service, and

2. Planning to use the drivers of costs in those activities in the most efficient way.

8-2 At the start of an accounting period, a larger percentage of fixed overhead costs are

locked-in than is the case with variable overhead costs. When planning fixed overhead costs, a

company must choose the appropriate level of capacity or investment that will benefit the

company over a long time. This is a strategic decision.

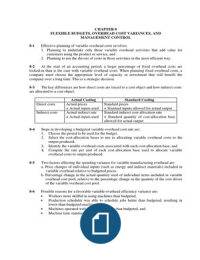

8-3 The key differences are how direct costs are traced to a cost object and how indirect costs

are allocated to a cost object:

Actual Costing Standard Costing

Direct costs Actual prices Standard prices

× Actual inputs used × Standard inputs allowed for actual output

Indirect costs Actual indirect rate Standard indirect cost-allocation rate

× Actual inputs used × Standard quantity of cost-allocation base

allowed for actual output

8-4 Steps in developing a budgeted variable-overhead cost rate are:

1. Choose the period to be used for the budget,

2. Select the cost-allocation bases to use in allocating variable overhead costs to the

output produced,

3. Identify the variable overhead costs associated with each cost-allocation base, and

4. Compute the rate per unit of each cost-allocation base used to allocate variable

overhead costs to output produced.

8-5 Two factors affecting the spending variance for variable manufacturing overhead are:

a. Price changes of individual inputs (such as energy and indirect materials) included in

variable overhead relative to budgeted prices.

b. Percentage change in the actual quantity used of individual items included in variable

overhead cost pool, relative to the percentage change in the quantity of the cost driver

of the variable overhead cost pool.

8-6 Possible reasons for a favorable variable-overhead efficiency variance are:

• Workers more skillful in using machines than budgeted,

• Production scheduler was able to schedule jobs better than budgeted, resulting in

lower-than-budgeted machine-hours,

• Machines operated with fewer slowdowns than budgeted, and

• Machine time standards were overly lenient.

8-1

, 8-7 A direct materials efficiency variance indicates whether more or less direct materials

were used than was budgeted for the actual output achieved. A variable manufacturing overhead

efficiency variance indicates whether more or less of the chosen allocation base was used than

was budgeted for the actual output achieved.

8-8 Steps in developing a budgeted fixed-overhead rate are

1. Choose the period to use for the budget,

2. Select the cost-allocation base to use in allocating fixed overhead costs to output

produced,

3. Identify the fixed-overhead costs associated with each cost-allocation base, and

4. Compute the rate per unit of each cost-allocation base used to allocate fixed overhead

costs to output produced.

8-9 The relationship for fixed-manufacturing overhead variances is:

Flexible-budget variance

Efficiency variance

Spending variance (never a variance)

There is never an efficiency variance for fixed overhead because managers cannot be

more or less efficient in dealing with an amount that is fixed regardless of the output level. The

result is that the flexible-budget variance amount is the same as the spending variance for fixed-

manufacturing overhead.

8-10 For planning and control purposes, fixed overhead costs are a lump sum amount that is

not controlled on a per-unit basis. In contrast, for inventory costing purposes, fixed overhead

costs are allocated to products on a per-unit basis.

8-11 An important caveat is what change in selling price might have been necessary to attain

the level of sales assumed in the denominator of the fixed manufacturing overhead rate. For

example, the entry of a new low-price competitor may have reduced demand below the

denominator level if the budgeted selling price was maintained. An unfavorable production-

volume variance may be small relative to the selling-price variance had prices been dropped to

attain the denominator level of unit sales.

8-2