ASSIGNMENT 2 2025

UNIQUE NO. 865771

DUE DATE: 30 AUGUST 2025

,Credit Risk Management

Question 1

a. Credit default swaps (CDS) are vital financial instruments in credit risk management.

They offer a means for investors to hedge against the risk of default by a borrower. A

CDS acts like insurance: if a borrower defaults, the CDS seller compensates the buyer.

They also promote liquidity in bond markets and help with credit pricing (Hull, 2018).

b. Some investors oppose CDS due to systemic risk concerns. Speculation without

owning the underlying asset can destabilize markets. Additionally, they may introduce

moral hazard and lack transparency in over-the-counter markets (Stulz, 2010).

c. In the event Moepi Minerals defaults, Sedibelo Development Bank (the CDS seller)

pays the difference between the bond’s par and recovery value to Magong Platinum

Project. If no default occurs, Magong pays an annual premium (2.5% of R80m = R2m)

for three years (total R6m) and retains default protection.

Question 2

a. The portfolio’s expected return is calculated as follows:

E[Rp] = (0.45 × 0.12) + (0.20 × 0.08) + (0.35 × 0.13) = 11.55%

Portfolio variance:

σ² = (0.45² × 0.14²) + (0.20² × 0.13²) + (0.35² × 0.17²) + 2(0.45×0.20×0.02) +

2(0.45×0.35×0.04) + 2(0.20×0.35×0.03)

σ² ≈ 0.04296 → σ ≈ 20.72%

b. Credit portfolio beta measures how sensitive a credit portfolio is to systemic market

movements. It helps assess potential losses during downturns and guides asset

allocation strategies (Jarrow & Turnbull, 2000).

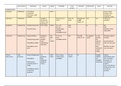

, Question 3

a. Project: Nairobi Expressway, Kenya

Location: Nairobi City

Project Sponsors: China Road and Bridge Corporation (CRBC), Kenyan Government

Project Lenders: Industrial and Commercial Bank of China

Consultants: Kenya Urban Roads Authority (KURA), Ministry of Transport

b. Risks and mitigants:

- Construction risk: mitigated by EPC contracts

- Political risk: mitigated by treaties and insurance

- Demand risk: addressed with revenue guarantees

- Environmental risk: controlled via EIA compliance

- Legal risk: managed through proper contract terms

c. Advantages:

- Reduced travel time and traffic

- Job creation

- Attraction of foreign investment

- Regional economic development

- Increased government revenue

Question 4

Average Inventory = (26+24)/2 = 25m

Average Receivables = (25+23)/2 = 24m

Average Payables = (16+18)/2 = 17m

COGS = 60% of R150m = R90m

Inventory Conversion Period = (25/90)*365 ≈ 101.39 days

Receivables Period = (24/150)*365 ≈ 58.4 days

Payables Period = (17/90)*365 ≈ 68.9 days