Ons is vandag hier as gevolg van

DIE LIEFDE WAT VOOR

ONS GEKOM HET

1993

HANLU & YOLANDÉ

Ontmoet in Saldanhabaai. Yolandé het as

ontvangs by Hoedjiesbaai Hotel gewerk en

Hanlu was ‘n polisieman. Gereelde besoeke

aan die hotel en polisiestasie (nie

werksverwant) was die begin van ’n besondere

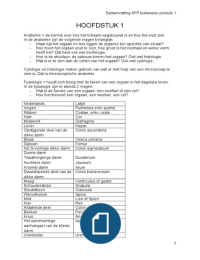

TAXATION

en lewenslange liefdesverhaal.

CHRIS & ERICA

1993

Beide het regte aan Kovsies geswot. Chris

was ‘n beter student as Erica (wat sy ontken),

771

maar het tog sy notas in haar posbus voor

belangrike toetse gelos. Albei het hokkie vir

die Universiteit gespeel en die res is

geskiedenis.

HENCO SE OUERS INGE SE OUERS

1965

ISAK & ELIZE

Ontmoet aan die Weskus in die Dwarskerbos

omgewing waar beide families woonagtig was.

Hanlu het in oupa se voetspore gevolg en ook

‘n polisieman geword terwyl ouma ‘n

tuisteskepper was. Jong verliefdes wat ‘n lang

pad saam geloop het. 1957

HANNES & ANNETTE

Beide het BA met Latyn en Engels aan die

UVS studeer en het mekaar in die klas

ontmoet. Oupa Hannes het vir ouma Annette

met haar Latyn huiswerk gehelp, klaarblyklik

omdat dit vir haar te moeilik was (al was sy

slim en nogal mooi ook)

HANLU SE OUERS CHRIS SE OUERS

1967

COENRAAD & ELIZABETH

Ontmoet by ‘n boere opskop en raak

halsoorkop verlief. Die liefde is nie altyd so

geduldig nie en hulle trou pas nadat hulle

skool voltooi. Ouma was ‘n boekhoudster en

oupa ‘n grafsteenmaker. Vrolik en lief vir

dans.

1957

GIEL & MARA

Ontmoet in Bloemfontein. Oupa Giel was ‘n

gesondheids inspekteur en ouma Mara ‘n

debiteure klerk. Hulle vestig in Windhoek en

was Suidwesters in murg en been. Lief vir

bier en biltong, soos hulle kinders.

YOLANDÉ SE OUERS ERICA SE OUERS

,

, RESIDENCY

Ordinarily resident

CASE CIR vs COHEN CIR vs KUTTEL

resident of South Africa non-resident of South Africa

PRINCIPLE • where someone has the intention to return • country where one normally resides apart from occasional

• Country to which a person will naturally and as a matter of absences, one’s “true home” (where creating a home)

course return to • Place where person normally resides apart from occasional/

• Usual/ principle residence temporary

• Physical presence is not decisive

- look at a person’s “true home”

- eg: has no family or property in South Africa (CIR vs KUTTEL) & only visits South Africa for work / holiday purposes & will ultimately return to USA =

not ordinarily resident in South Africa not a resident for SARS tax purposes

Beginning and ending of being ordinarily resident

• Person immigrating to RSA will be resident from the day he/she becomes ordinarily resident

• Person emigrating from RSA will become a non-resident from the day he/she boards the aircraft

• A person who immigrates to or emigrates from RSA in a YOA will be partially resident and partially non-resident in that YOA – do not apply the

physical presence test in that YOA

Example: Natural person emigrates on 1 Oct 2020

no broken period of assessment

Perform a SINGLE calculation:

• 2021 YoA resident = worldwide income

• 2021 YoA non-resident = source income

Do not apportion the s 6(2) rebates.

emigration: can only apply ORDINARILY RESIDENCE test

Physical Presence test:

a natural person who is not at any time in the relevant year of assessment “ordinarily resident” will be a resident if they are physically present in the Republic

according to the physical presence test

requirements:

physically present in South Africa for period:

• exceeding 91 days in the current YoA

• exceeding 91 days in each preceding 5 YoAs (2017-2021)

• exceeding 915 days in the preceding 5 YoAs

cease to be physically present in South Africa

outside of South Africa for a period of 330 continuous full days from day after departure

Beginning and ending of being a resident i.t.o physical presence test

• Resident in YOA in which requirements of PPT are met – i.e. then person is resident for full YOA (6th year)

• Resident (i.t.o) PPT who leaves RSA and remains absent for at least 330 consecutive days: non-resident from the day on which he/she left RSA

• Remember that the 330-day rule is not applicable to persons who are ordinarily resident

, EXAMPLE:

Lexi meets the requirements of the physical presence test in the 2022 YoA

ð will be deemed to be a resident for SA Income Tax purposes from the first day of the 2022 YoA (1 Mar 2021)

ð taxed as resident: 1 March 2021 day before departure

ð taxed as non-resident: day after departure 28 February 2022

ð note: the 330 days will always extend over 2 years of assessment

ð on 28 February 2022 the TP would not have been able to provide evidence of compliance with the 330 day rule

ð the taxpayer would have been taxed as a resident for entire YoA

example:

Taxpayer flew from SA to UK on 1 June 2019 & remained physically outside SA up to & including 15 May 2020

1 March 2019 29 Feb 2020 15 May 2020

31 May 1 Jun 2 Jun ‘19

emigration: counting days:

YoA ends on day immediately before from 2 June (1 June = transit day)

TP ceases to be a resident

next YoA deemed to commence on RULES:

day ceases to be a resident part of a day = whole day

transit day = excluded

the taxpayer is out of the country for more than 330 continous days therefore with

Respect to S9H 2(b) for YoA:

resident: 1 March – 31 May 2019

non-resident: 1 June 2019 – 29 February 2020

Residence of persons other than natural persons

(par (b) of the definition of ‘resident’)

person = other entities i.e business / trust

Residence tests - Incorporated or established or formed in RSA

Other than natural persons OR

Effectively managed in RSA

(where key management & commercial decisions are made over the long-run)

Double taxation agreements If DTA deems a person to be exclusively a resident of another country

(DTAs) THEN

Not a resident of RSA even if requirements of residence are met

Change of residence: s9H

resident non-resident

at the point where a person becomes a non-resident

• Deemed disposal of assets at MV (Recoupments & CGT)

• WHEN? on the date immediately before the day on which the

person ceases to be a resident

DIE LIEFDE WAT VOOR

ONS GEKOM HET

1993

HANLU & YOLANDÉ

Ontmoet in Saldanhabaai. Yolandé het as

ontvangs by Hoedjiesbaai Hotel gewerk en

Hanlu was ‘n polisieman. Gereelde besoeke

aan die hotel en polisiestasie (nie

werksverwant) was die begin van ’n besondere

TAXATION

en lewenslange liefdesverhaal.

CHRIS & ERICA

1993

Beide het regte aan Kovsies geswot. Chris

was ‘n beter student as Erica (wat sy ontken),

771

maar het tog sy notas in haar posbus voor

belangrike toetse gelos. Albei het hokkie vir

die Universiteit gespeel en die res is

geskiedenis.

HENCO SE OUERS INGE SE OUERS

1965

ISAK & ELIZE

Ontmoet aan die Weskus in die Dwarskerbos

omgewing waar beide families woonagtig was.

Hanlu het in oupa se voetspore gevolg en ook

‘n polisieman geword terwyl ouma ‘n

tuisteskepper was. Jong verliefdes wat ‘n lang

pad saam geloop het. 1957

HANNES & ANNETTE

Beide het BA met Latyn en Engels aan die

UVS studeer en het mekaar in die klas

ontmoet. Oupa Hannes het vir ouma Annette

met haar Latyn huiswerk gehelp, klaarblyklik

omdat dit vir haar te moeilik was (al was sy

slim en nogal mooi ook)

HANLU SE OUERS CHRIS SE OUERS

1967

COENRAAD & ELIZABETH

Ontmoet by ‘n boere opskop en raak

halsoorkop verlief. Die liefde is nie altyd so

geduldig nie en hulle trou pas nadat hulle

skool voltooi. Ouma was ‘n boekhoudster en

oupa ‘n grafsteenmaker. Vrolik en lief vir

dans.

1957

GIEL & MARA

Ontmoet in Bloemfontein. Oupa Giel was ‘n

gesondheids inspekteur en ouma Mara ‘n

debiteure klerk. Hulle vestig in Windhoek en

was Suidwesters in murg en been. Lief vir

bier en biltong, soos hulle kinders.

YOLANDÉ SE OUERS ERICA SE OUERS

,

, RESIDENCY

Ordinarily resident

CASE CIR vs COHEN CIR vs KUTTEL

resident of South Africa non-resident of South Africa

PRINCIPLE • where someone has the intention to return • country where one normally resides apart from occasional

• Country to which a person will naturally and as a matter of absences, one’s “true home” (where creating a home)

course return to • Place where person normally resides apart from occasional/

• Usual/ principle residence temporary

• Physical presence is not decisive

- look at a person’s “true home”

- eg: has no family or property in South Africa (CIR vs KUTTEL) & only visits South Africa for work / holiday purposes & will ultimately return to USA =

not ordinarily resident in South Africa not a resident for SARS tax purposes

Beginning and ending of being ordinarily resident

• Person immigrating to RSA will be resident from the day he/she becomes ordinarily resident

• Person emigrating from RSA will become a non-resident from the day he/she boards the aircraft

• A person who immigrates to or emigrates from RSA in a YOA will be partially resident and partially non-resident in that YOA – do not apply the

physical presence test in that YOA

Example: Natural person emigrates on 1 Oct 2020

no broken period of assessment

Perform a SINGLE calculation:

• 2021 YoA resident = worldwide income

• 2021 YoA non-resident = source income

Do not apportion the s 6(2) rebates.

emigration: can only apply ORDINARILY RESIDENCE test

Physical Presence test:

a natural person who is not at any time in the relevant year of assessment “ordinarily resident” will be a resident if they are physically present in the Republic

according to the physical presence test

requirements:

physically present in South Africa for period:

• exceeding 91 days in the current YoA

• exceeding 91 days in each preceding 5 YoAs (2017-2021)

• exceeding 915 days in the preceding 5 YoAs

cease to be physically present in South Africa

outside of South Africa for a period of 330 continuous full days from day after departure

Beginning and ending of being a resident i.t.o physical presence test

• Resident in YOA in which requirements of PPT are met – i.e. then person is resident for full YOA (6th year)

• Resident (i.t.o) PPT who leaves RSA and remains absent for at least 330 consecutive days: non-resident from the day on which he/she left RSA

• Remember that the 330-day rule is not applicable to persons who are ordinarily resident

, EXAMPLE:

Lexi meets the requirements of the physical presence test in the 2022 YoA

ð will be deemed to be a resident for SA Income Tax purposes from the first day of the 2022 YoA (1 Mar 2021)

ð taxed as resident: 1 March 2021 day before departure

ð taxed as non-resident: day after departure 28 February 2022

ð note: the 330 days will always extend over 2 years of assessment

ð on 28 February 2022 the TP would not have been able to provide evidence of compliance with the 330 day rule

ð the taxpayer would have been taxed as a resident for entire YoA

example:

Taxpayer flew from SA to UK on 1 June 2019 & remained physically outside SA up to & including 15 May 2020

1 March 2019 29 Feb 2020 15 May 2020

31 May 1 Jun 2 Jun ‘19

emigration: counting days:

YoA ends on day immediately before from 2 June (1 June = transit day)

TP ceases to be a resident

next YoA deemed to commence on RULES:

day ceases to be a resident part of a day = whole day

transit day = excluded

the taxpayer is out of the country for more than 330 continous days therefore with

Respect to S9H 2(b) for YoA:

resident: 1 March – 31 May 2019

non-resident: 1 June 2019 – 29 February 2020

Residence of persons other than natural persons

(par (b) of the definition of ‘resident’)

person = other entities i.e business / trust

Residence tests - Incorporated or established or formed in RSA

Other than natural persons OR

Effectively managed in RSA

(where key management & commercial decisions are made over the long-run)

Double taxation agreements If DTA deems a person to be exclusively a resident of another country

(DTAs) THEN

Not a resident of RSA even if requirements of residence are met

Change of residence: s9H

resident non-resident

at the point where a person becomes a non-resident

• Deemed disposal of assets at MV (Recoupments & CGT)

• WHEN? on the date immediately before the day on which the

person ceases to be a resident