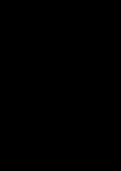

CHAPTER 02 – ACCOUNTING PROCESS

Trial Balance

6

5

4

3

2

1

0

May 18 Nov 18 May 19 Nov 19 Nov 20 Jan 21 July 21 Dec 21 May 22 Nov 22 May 23 Dec 23

5 5 4

Ledger

6

5

4

3

2

1

0

May 18 Nov 18 May 19 Nov 19 Nov 20 Jan 21 July 21 Dec 21 May 22 Nov 22 May 23 Dec 23

5

Subsidiary Books

12

10

8

6

4

2

0

May 18 Nov 18 May 19 Nov 19 Nov 20 Jan 21 July 21 Dec 21 May 22 Nov 22 May 23 Dec 23

10 4

,CHAPTER 02 - ACCOUNTING PROCESS 2.2

Evidence of the Record the

Contains the totals from

transactions transactions for the

various ledger accounts

first time

Source Book of Ledger Trial Final

Documents Original Entry Accounts Balance Accounts

Classification and grouping of Statement of the financial

recorded entries performance and position of

a business entity

Every business transaction has two-fold effect and recording of both aspects of a transaction

is called double entry system of book-keeping. For e.g. On purchase of furniture cash balance

will be reduced.

Identify the two accounts Involved in each of the following transactions

Transaction Accounts Involved

• Salary A/c

Salary paid to Ratnakar Rs. 7,500

• Cash A/c

• Goods A/c

Purchased goods from Diwakar Rs. 1,000 on Credit.

• Diwakar A/c

• Prabhakar A/c

Sold goods to prabhakar Rs. 8,000

• Goods A/c

• Cash A/c

Received Rs. 500 as commission

• Commission A/c

• Furniture A/c

Bought furniture from Kamalakar Rs. 3,500

• Kamalakar A/c

• Rent A/c

Paid to shubham Rs. 1,200 for rent.

• Cash A/c

• Bank A/c

Deposited Rs. 5,000 in Bank.

• Cash A/c

,CHAPTER 02 - ACCOUNTING PROCESS 2.3

The ledger account is divided into two parts. Left and right-hand sides of the account are

conventionally called debit side (Dr.) and credit side (Cr.) respectively. Entries on left and

right hand side are called debit and credit entries respectively. It is customary to right ‘To’

and ‘By’ respectively while recording entries on debit and credit side of the account.

Left Side Debit To

Right Side Credit By

• Increases in assets are debits; decreases are credits;

• Increases in liabilities are credits; decreases are debits;

• Increases in owner’s capital are credits; decreases are debits;

• Increases in expenses are debits; decreases are credits; and

• Increases in revenue or incomes are credits; decreases are debits.

Transactions in the journal are recorded on the basis of the rules of debit and credit only

Accounts

Personal Accounts Impersonal Accounts

Natural Artificial (Legal) Representative

Real Nominal

Tangible Intangible

, CHAPTER 02 - ACCOUNTING PROCESS 2.4

A. PERSONAL ACCOUNTS :

Accounts recording transactions with a person or group of persons are called personal accounts.

Personal accounts are of following types:

1. NATURAL PERSON(S) 2. ARTIFICIAL LEGAL 3. ROUP/REPRESENTATIVE

ACCOUNTS :- are accounts PERSONAL ACCOUNT :- PERSONAL ACCOUNT :-Group

of individual living beings For business purpose, a personal accounts are accounts

and include accounts of business entity is treated of natural and legal persons

individuals such as Rohit to have separate entity. grouped together such as debtors

Capital Account, Ram They are recognised as account, creditors account, share

Account, Neha Account persons in the eye of law capital account etc. Commission

and so on. for dealing with other outstanding account, salaries

persons. Eg. Government, outstanding account etc.

Companies, Clubs, represent the person to whom

Cooperative societies. commission or salary is payable

and not yet paid and are called

representative personal

accounts.

B. IMPERSONAL ACCOUNTS:

Accounts which are not personal are termed as personal accounts and are divided into real and

nominal accounts.

REAL ACCOUNTS : Real Accounts relate to properties of a NOMINAL ACCOUNTS:

business enterprise, which can be tangible or intangible: Accounts relating to

income, revenue, gain,

TANGIBLE REAL INTANGIBLE REAL ACCOUNTS :- expenses and losses are

ACCOUNTS : - Includes accounts of things which termed as nominal

Accounts of cannot be physically felt or touched accounts. Examples of

properties having but are capable of monetary nominal accounts are

physical existence measurement such as accounts of salaries, rent, commission,

like cash, building, goodwill, patents rights, trade marks discount allowed, rent

stock of goods, right, copy rights etc. received, sales, interest

furniture etc.is Thus real accounts are accounts of received etc.

called tangible real tangible objects or intangible rights,

accounts. legal or self-created, owned by a

business enterprise.