Ratios are calculated to show the organization what financial state they are in and

give them a better understanding of how well the company is performing financially.

Therefore businesses like the way I am doing is Mainwaring engineering, and they

carried out a ratio analysis on a regular basis to monitor the state of the business,

however ratios are not very accurate as they only give an estimate or a predicted

figure so the business has to be careful and not make major decision based on

ratios. In this report I'll evaluate the adequacy of accounting ratios are in terms of

monitoring the state of the business, in this case Mainwaring engineering.

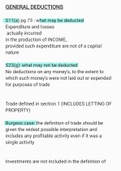

Mainwaring Mainwaring Industry averages

engineering year engineering year for year ending

ending March 2011 ending March 2012 March 2012

Return on capital 7.8% 69/850x100 = 8.1 8%

employed

Gross profit 48% 717/1,628X100 = 40%

percentage 44

Net profit 76% 69/1,628X100 = 75%

percentage 4.2

Stock turnover 92 days 237/911X100 = 95 95 days

Debtor collection 58 days 269/1,628X365 = 55 days

period 60.3

Creditor payment 60 days 212/1190X365 = 57 days

period 65

Current ratio 2.6:1 507/212 = 2.4:1 2.5:1

Acid test 2.5:1 507-237/212 = 1.4:1

1.3:1

Liquidity ratios

The current ratio for Mainwaring engineering in 2012 was 2.4:1, last year it was

2.6:1. Last year the current ratio was good because it is high therefore they had

more chance to save the money, and pay off the debts, but as the year went passed

the current ratio decreased to 2.4:1 and the industry averaged it at 2.5:1 and this is

bad because it went below the business average and this means that the business

will have to sell their liabilities to cover up the debt. In order for the company to

avoid this problem such as not being able to cover short term debt, the company

should reserve some money to be able to pay off the liabilities. The strength of this

current ratio is that in 2011 the result was 2.6:1 which meant that the company had

more money to pay off to the debts, instead of paying it off with the liabilities;

furthermore it has surpassed the industry averages. The other strength is that the

current ratio data will able to show the business if they are able to pay off the short

, term debts. The weakness of this current ratio is that it has decreased from 2.6:1 to

2.4:1 which is bad, as the company averaged the year at 2.5:1, but the business

went below that and this means that it has less money to pay off the debts,

therefore they will need to pay it off with their liabilities.

The acid ratio for Mainwaring engineering in 2012 was 1.3:1, last year it was 1.5:1.

Last year the acid ratio was good because it is high therefore they had more chance

to save the money, and pay off the debts, but as the year went passed the current

ratio decreased to 1.3:1 and the industry averaged it at 1.4:1 and this is bad

because it went below the business average and this means that the business will

have to pay money without selling any stock to cover up the debt. In order for the

company to avoid this problem such as not being able to cover short term debt, the

company should reserve some money to be able to pay off the debt. The strength of

this current ratio is that in 2011 the result was 1.5:1 which meant that the company

had more money to pay off to the debts, instead of paying it off with the liabilities;

furthermore it has surpassed the industry averages. The other strength is that the

acid ratio data will help the company if they will need to pay short term obligations,

so if the ratio is high than the company is stabilized, whereas if it’s low then they

will be more risk and that’s how the liquidity ratio shows the data. The weakness of

this current ratio is that it has decreased from 1.5:1 to 1.3:1 which is bad, as the

company averaged the year at 1.4:1, but the business went below that and this

means that it has less money to pay off the debts, therefore they will need to

reserve more money to pay it off.

Profitability ratios

For return on capital employed, during the year ending of March 2011 the

percentage for it was 7.8%. The next year of the ending of March, the percentage is

8.1% which was good because the industry averaged it at 8%. As you can see the

comparison between the years, in 2011 it was at 7.8% and it has increased next

year to 8.1% which was more than expected and this is excellent job for the

company of Mainwaring engineering. The increase of percentage indicates that the

company’s performance has been better and improved this may be because of

more sales and better efficiency of the business. The strength is that the business

has increased their profit margin from 2011 to 2012, and it has increased by 3

percent which surpassed the industry average by 1 percent and this is a good factor

for the business. The other strength is that ROCE is a useful ratio for comparing

profitability and performances across the companies, and this could be a good

indicator for the head office to make decisions. The weakness is that the previous

year it made 7.8% due to poor performance of the business, but it may decrease in

percentage in 2013 is the business doesn't perform well.

The gross profit percentage for Mainwaring engineering in 2012 was 44%, last year

2011 it was 48%. Last year the gross profit was terrific because of the high

percentage of gross profit and this indicates that the business performance and