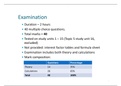

Examination

Duration – 2 hours

40 multiple choice questions.

Total marks = 40

Tested on study units 1 – 15 (Topic 5 study unit 16,

excluded)

Not provided: interest factor tables and formula sheet

Examination includes both theory and calculations

Mark composition:

Questions Percentage

Theory 14 35%

Calculations 26 65%

Total 40 100%

, Stuvia.com - The study-notes marketplace

Examination

The following questions will be tested from each topic:

Questions

Topic 1 The Investment 14

Background

Topic 2 Equity Analysis 4

Topic 3 The Analysis of Bonds 8

Topic 4 Portfolio Management 14

Total 40

, Stuvia.com - The study-notes marketplace

TOPIC 1

THE INVESTMENT BACKGROUND

, Stuvia.com - The study-notes marketplace

CHAPTER 1: INTRODUCTION

An investment is:

a current commitment of money, based on fundamental research

to real and/or financial assets for a given period

in order to accumulate wealth over the long term

Goal of investment management

Find investment returns that satisfy the investor’s required rate of

return

Required rate of return – is the return that should compensate

the investor for:

Time value of money during the period of investment

The expected rate of inflation during the period of investment

The risk involved

, Stuvia.com - The study-notes marketplace

Required Rate of Return

To determine the required rate of return:

The investor has to determine the nominal risk free rate

of return

Then add risk premium to compensate for the risk

associated with the investment

NRFR =[(1 + RRFR)(1 + EI)]

Where: RRFR = real rate of return (in decimal form)

EI = expected inflation (in decimal form)

RRFR = (1 + NRFR) – 1

(1 + EI)