S8 allowances Study guides, Study notes & Summaries

Looking for the best study guides, study notes and summaries about S8 allowances? On this page you'll find 4 study documents about S8 allowances.

All 4 results

Sort by

-

CGSC F107-F110-Exam 2022/2023 Questions and Answers

- Exam (elaborations) • 7 pages • 2022

-

- R190,45

- + learn more

Who is responsible for the PPBE Process - ANSWER The Ass. SEC for the Army , Ass. SEC Financial Management and Comptroller (ASA(FM&C)) what is the starting point for the PPBE programming Phase - ANSWER TAA Outputs of TAA - ANSWER ARSTRUC, POM Force what does PPBE Stand for? - ANSWER Planning, Programming, Budgeting and Executions What is the PPBE Process? - ANSWER DoD Resource management system. primary means for SEC DEF. to control allocations of resources. What are the inputs to...

-

Summary of Lecture notes Taxation SAICA Student Handbook, 2021/2022, ISBN: 9780639014050

- Class notes • 1 pages • 2022

-

- R50,00

- + learn more

A glimpse into South Africas income tax act, it is a small summary to help you study and understand the taxable income and tax payable of individuals and companies. it walks you through many steps in the framework and has helpful hints to assist you in reaching the correct answer

-

Tax 3B: allowances and reimbursements

- Summary • 7 pages • 2022

- Available in package deal

-

- R50,00

- + learn more

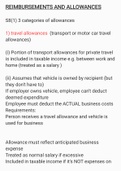

Summary of the treatment and calculation of allowances and deductions as set out in S8 of the income tax act.

-

Tax 771 - Chapters 7 -11

- Summary • 66 pages • 2020

- Available in package deal

-

- R100,00

- + learn more

Honours tax notes created in 2020 1st Term. Chapter 7 is information relating to Natural Persons including a format page. Chapter 8 is all the S8(1) allowances and taxable fringe benefits found in the Seventh Schedule of the Income Tax Act. Chapter 9 is the Second Schedule on the Income Tax Act Retirement benefits. Chapter 10 and 11 are based on the Fourth Schedule of the Income Tax for Employees Tax and Provisional Tax respectively.

How much did you already spend on Stuvia? Imagine there are plenty more of you out there paying for study notes, but this time YOU are the seller. Ka-ching! Discover all about earning on Stuvia