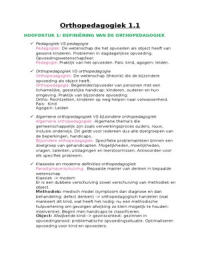

ER based on EARNINGS

Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5

- No synergies - All synergy benefits to - All synergy – benefits to - Synergy benefits share - Synergy earnings

EPS (t) Target the acquirer proportionally between A proportionally shared ( not

ER= - Calc Max number of shares - Need to calc Min ER ratio and T ( Stipulated %) specified which portion)

EPS(a)

- Earnings for each A is willing to issue - T shareholders don’t want SE

EPS ( t ) +%

shareholder remains the - A shareholders should not to lose i.t.o. earnings. N (t ) -

be in worse position after - If advise the T, need to calc - ER= EPS (t )

same SE ER=

- MV of A shareholders merger the Min ER ratio EPS ( a ) +% EPS (a)

N ( a)

decrease - If advise A, need to - Earnings of both T and A

- MV of T shareholders determine Max ER EPS ( t ) shareholders increase with

ER= - Earnings of both A and T

increase SE shareholders will increase the same %

SE EPS ( a ) +100 %

- We cannot control the MV. EPS ( t ) +100 % N (a)

N (t ) - A shareholders earnings

ER=

EPS (a) increase

- A shareholders earnings - T shareholders earnings

remain the same remain the same.

- T shareholders earnings

increase

STEPS

1. Calculate the ER based on the scenario

2. Calculate the new number of issued shares by A

MERGED EARNINGS(m)

3. Calculate the new EPS post merger - EPS ( m )=

NEW NUMBER ISSUED SHARES

Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5

- No synergies - All synergy benefits to - All synergy – benefits to - Synergy benefits share - Synergy earnings

EPS (t) Target the acquirer proportionally between A proportionally shared ( not

ER= - Calc Max number of shares - Need to calc Min ER ratio and T ( Stipulated %) specified which portion)

EPS(a)

- Earnings for each A is willing to issue - T shareholders don’t want SE

EPS ( t ) +%

shareholder remains the - A shareholders should not to lose i.t.o. earnings. N (t ) -

be in worse position after - If advise the T, need to calc - ER= EPS (t )

same SE ER=

- MV of A shareholders merger the Min ER ratio EPS ( a ) +% EPS (a)

N ( a)

decrease - If advise A, need to - Earnings of both T and A

- MV of T shareholders determine Max ER EPS ( t ) shareholders increase with

ER= - Earnings of both A and T

increase SE shareholders will increase the same %

SE EPS ( a ) +100 %

- We cannot control the MV. EPS ( t ) +100 % N (a)

N (t ) - A shareholders earnings

ER=

EPS (a) increase

- A shareholders earnings - T shareholders earnings

remain the same remain the same.

- T shareholders earnings

increase

STEPS

1. Calculate the ER based on the scenario

2. Calculate the new number of issued shares by A

MERGED EARNINGS(m)

3. Calculate the new EPS post merger - EPS ( m )=

NEW NUMBER ISSUED SHARES