Exam (elaborations)

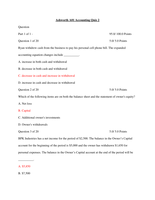

Ashworth A01 Accounting Quiz 2

- Course

- Institution

Question Part 1 of 1 - 95.0/ 100.0 Points Question 1 of 20 5.0/ 5.0 Points Ryan withdrew cash from the business to pay his personal cell phone bill. The expanded accounting equation changes include __________. A. increase in both cash and withdrawal B. decrease in both cash and withd...

[Show more]